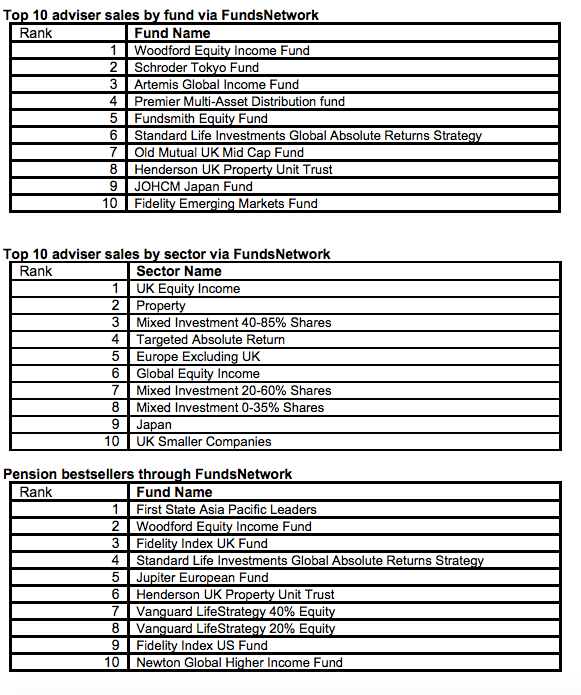

FundsNetwork says that its sales data reveals that amid turbulent markets centred around China’s stock market crisis in August, investors have taken shelter within defensive assets.

With continuing volatility and defensive investor sentiment, the UK Equity Income sector reasserted its dominance in the sales charts for August by comfortably retaining its top spot in the sales chart, outselling the second most popular sector, Property, by nearly two to one. The Mixed Investment sectors and Targeted Absolute Returns also continued to find favour with cautious investor in the month.

However, while the UK Equity Income sector saw a significant increase in sales, this was not driven by increased flows into the Woodford Equity Income Fund, despite the fact that it retained the top spot in the overall fund sales. This suggests that advisers and their clients are diversifying their UK Equity Income exposure.

A similar trend was evident with the Isa sales which saw UK Equity Income and Woodford Equity Income stay at the top of the bestsellers tables. However, Standard Life Investments Global Absolute Returns Strategy was unable to hold onto its second place spot in the month, losing out to Premier Multi Asset Distribution.

{desktop}{/desktop}{mobile}{/mobile}

In the FundsNetwork Pension, despite significant volatility and investor caution over the markets, investors kept their faith in trackers, with Fidelity Index UK and Fidelity Index US remaining in the top ten bestsellers list.

Danny Wynn, head of fund partners for Fidelity Worldwide Investment, said: “In August, we witnessed some of the worst market volatility since the eurozone crisis of 2011. Understandably, this led to a continued defensive mind-set among advisers and their clients and we once again saw defensive assets dominate sales on FundsNetwork.”