Transact is to cut some of its charges in April with annual commission charges and buy commission charges both reduced.

The company says the reduction in charges is its 14th since 2008.

The news comes as Transact’s parent Integrafin today posted post-tax profits up 11% to £45.5m and Funds Under Direction up 9% to £41.09bn.

Gross inflows for the year were up 1% to £5.75bn.

The company said despite the modest growth in inflows it was pleased with the figures against a backdrop of Coronavirus challenges. It said the immediate future looked challenging with Brexit uncertainty ahead but longer term prospects for the platform sector were positive.

Separately, the firm is involved in a bidding battle for rival platform Nucleus.

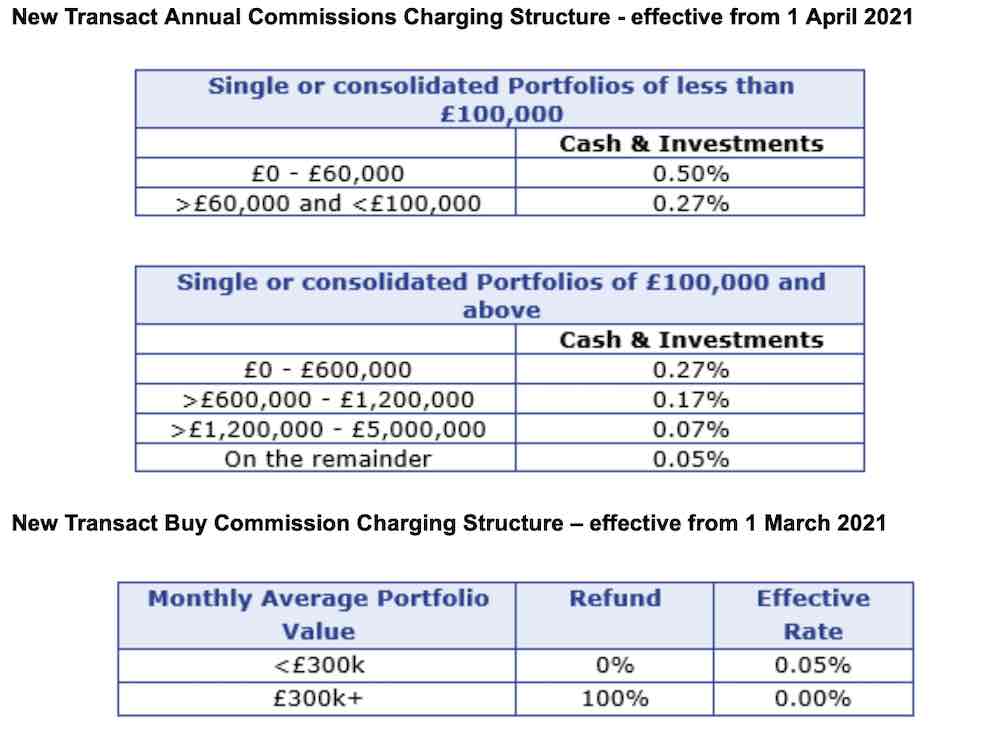

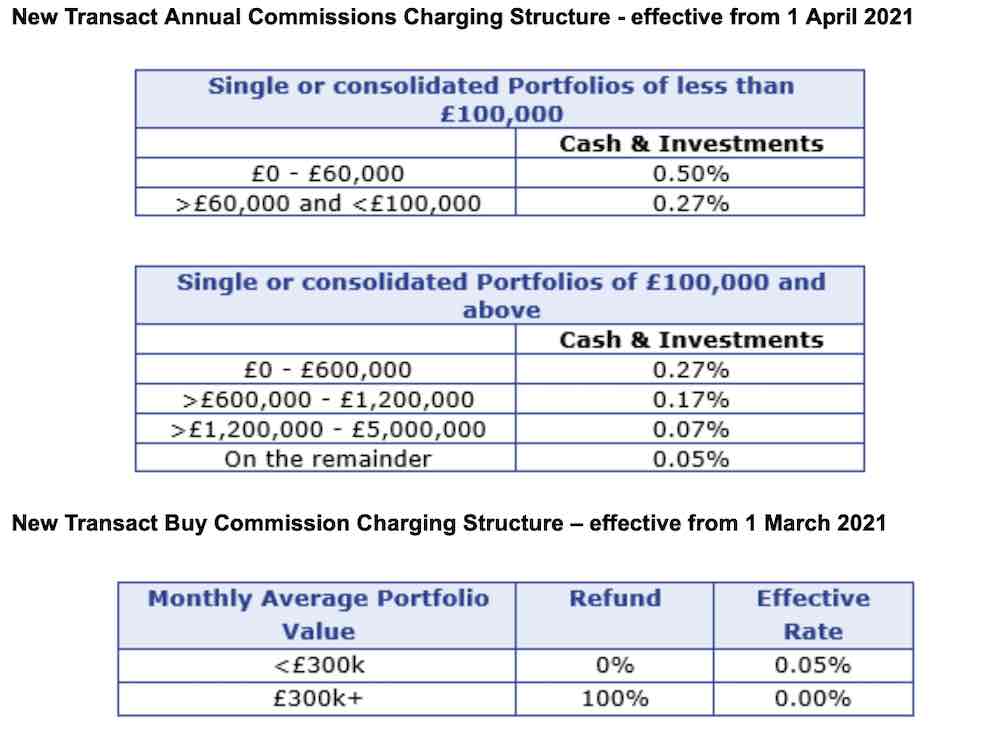

Transact CEO Jonathan Gunby said: “Following our results I am also pleased to be able to announce that we are once again reducing our charges. These reductions will benefit the majority of our existing and new customers. Annual Commission charges reduce from 0.28% to 0.27% and from 0.18% to 0.17% (for the respective charging bands) on 1 April 2021.

“Buy Commission exemption threshold reduces from £400k to £300k on 1 March 2021. As we once again reduce our charges (the 14th set of pricing reductions since 2008) we remain dedicated to providing exceptional service to advisers and clients. We have also been able to launch new functionality in 2020 and have more planned for 2021.”

Source: Integrafin/Transact

Talking about the annual results Integrafin CEO Alex Scott said: "Given the events that unfolded over the second half of our financial year, we are very pleased to deliver a robust set of results.

“Gross inflows of £5.75 billion remained at broadly the same level as last year, while net inflows of £3.59 billion were 3% higher. The increase in net inflows was driven by a reduction in outflows in the second half of the year. I am pleased to report that profit after tax increased by 11% to £45.5 million.”

The company has declared an interim dividend of 5.6 pence per ordinary share, taking the total dividend for the year to 8.3p per share (2019: 7.8 pence per ordinary share).

Average staff numbers fell from 509 to 492, a drop of 3% mainly due to "natural attrition and efficiency gains delivered through platform development," the company said.