Planners react as inflation hits 30-year high

UK inflation (CPI) rose by 5.4% in the 12 months to December, hitting a 30-year high.

CPI rose 5.1% in the 12 months to November.

The last time inflation was higher was in March 1992, when it was 7.1%

The Bank of England has previously said it expects inflation to peak at 6% this spring although some experts have forecast a rate of 7% or more.

The CPI rate continues to be well above the Bank of England’s 2% inflation target.

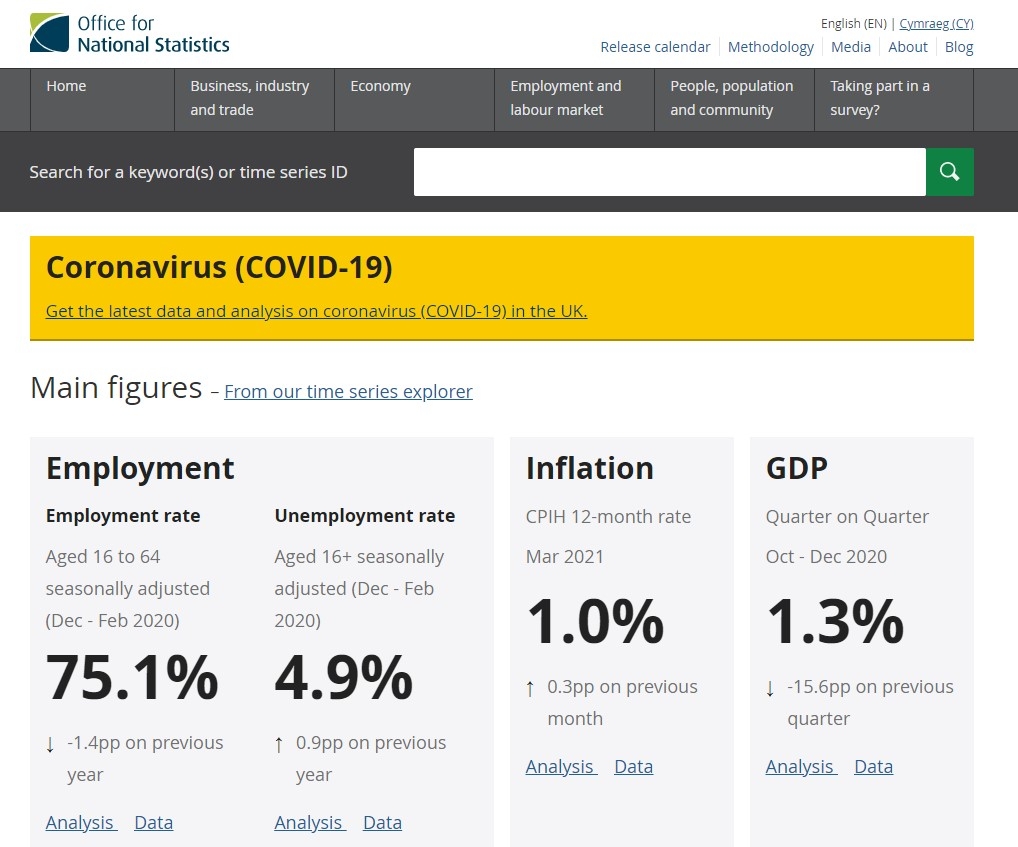

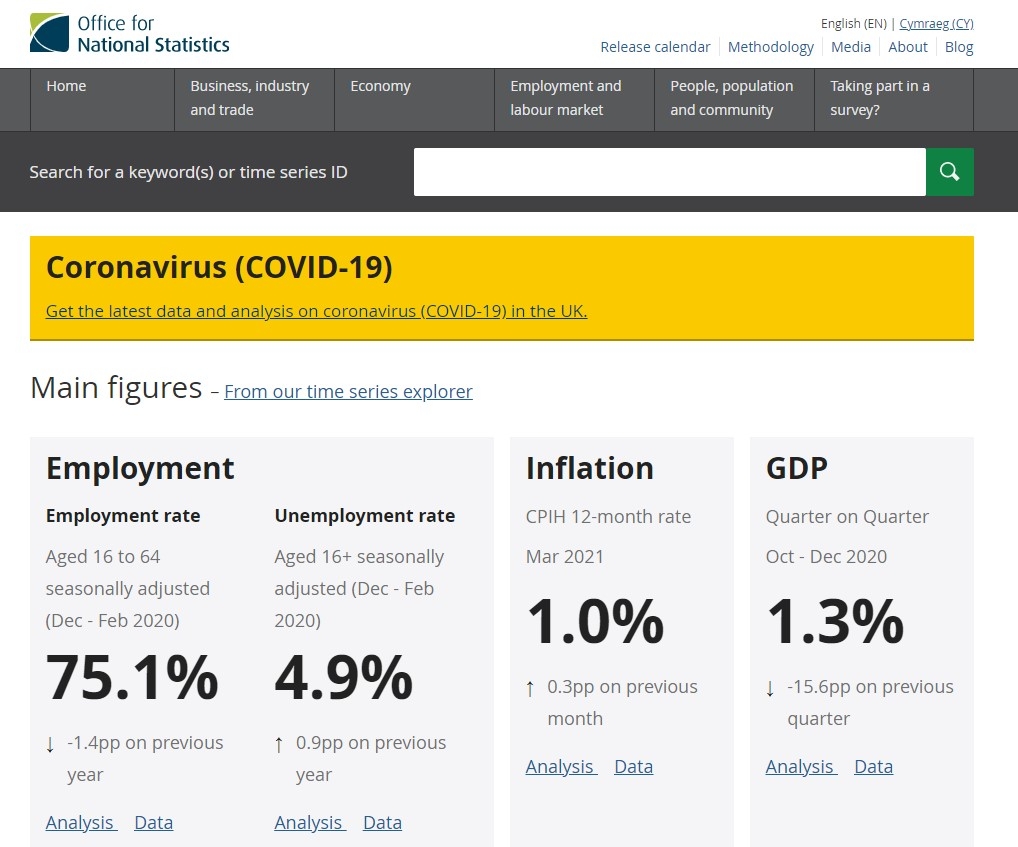

The CPI index including owner occupiers’ housing costs (CPIH) rose by 4.8% in the 12 months to December 2021, according to the latest figures from the Office for National Statistics.

On a monthly basis, CPI increased by 0.5% in December 2021, compared with a rise of 0.3% in December 2020.

The rising prices of food, drinks and household bills were the highest contributors to the rise in the cost of living.

Scott Gallacher, Chartered Financial Planner at Leicestershire-based Rowley Turton, said the rise in inflation is something that will affect Financial Planning firms as well as their clients.

He said: “"The rising cost of living is hitting everyone and we brought our annual pay rises forward by three months to help our staff with this. However, this is of course an additional cost to our business which we can't pass onto clients. We were lucky on the energy side as we took out a two-year fixed rate deal in the summer so that's at least one worry we don't have.

“Unfortunately, today's high inflation is a global problem and the government raising interest rates again in February will do little to contain it. But it could be disastrous for the UK economy by hitting hard-working families through higher mortgage costs."

This latest rise in inflation leaves UK households collectively needing to find an extra £41bn a year to maintain their standard of living compared to 12 months ago, according to Canada Life.

The average UK household will typically need to spend an extra £1,510 a year to maintain its standard of living.

Adam Walkom, co-founder at London-based Permanent Wealth Partners, said the latest CPI figures leave policymakers at the Bank of England “damned if they do and damned if they don’t”

He said: “There are never any good options with inflation. Raise rates to control it and reduce business momentum and make mortgages and debts more expensive. Let it run rampant and the cost of living keeps going up. Policymakers at the Bank of England are rediscovering this predicament now and are damned if they do and damned if they don't.

“This is why for many years all Central Banks have had a single mandate, which was to control inflation. This has slackened off over the last few years when inflation wasn't a concern and we are now paying the price — literally — for shifting priorities."

Paul Craig, portfolio manager at Quilter Investors, agreed the latest CPI figures have left the Bank of England with some tough decisions ahead of the next Monetary Policy Committee meeting.

He said: “The Bank of England is vindicated in its decision to hike rates in December in the face of Omicron uncertainty, but it could still go either way when the MPC meets.

“The MPC will be faced with a difficult trade-off between ensuring financial stability or helping households cope with a cost of living crisis that is set to squeeze household finances over a difficult winter period. It’s not just the cost of living that is increasing, so is the cost of going to work, and wage increases may not be enough to cover the cost of returning to normality. The ONS published figures showing wage growth of 3.8% yesterday, so workers are facing a real terms pay decline of 1.6%. Taken together, there is a very real concern that in-work poverty is growing.

“It seems like madness now that only a year ago we were pondering whether the Bank of England would take rates below zero, but even with inflation hitting 5.4%, things will get worse before they get better. Inflation is expected to peak in the second quarter before starting to settle down in the latter stages of 2022 and early 2023.”

Sarah Coles, personal finance analyst at Hargreaves Lansdown, predicted that we may see CPI rise above the 6% forecast by the Bank of England.

She said: "Inflation is the horrible 90s trend we didn’t want to see again, but it’s back. CPI inflation has hit 5.4% for the first time since it was first measured 25 years ago. If CPI had been around a bit longer, we wouldn’t have seen it this high for 30 years. And this isn’t the last of it: the Bank of England expects inflation to peak around 6% in April, but unless there’s significant intervention in the energy market, there’s every chance it could go as high as 7%."

Separate figures from the Office for National Statistics yesterday showed that average pay rises are failing to keep up with the rise in the cost of living. Regular pay, excluding bonuses and adjusted for inflation, fell by 1% in November (year on year).