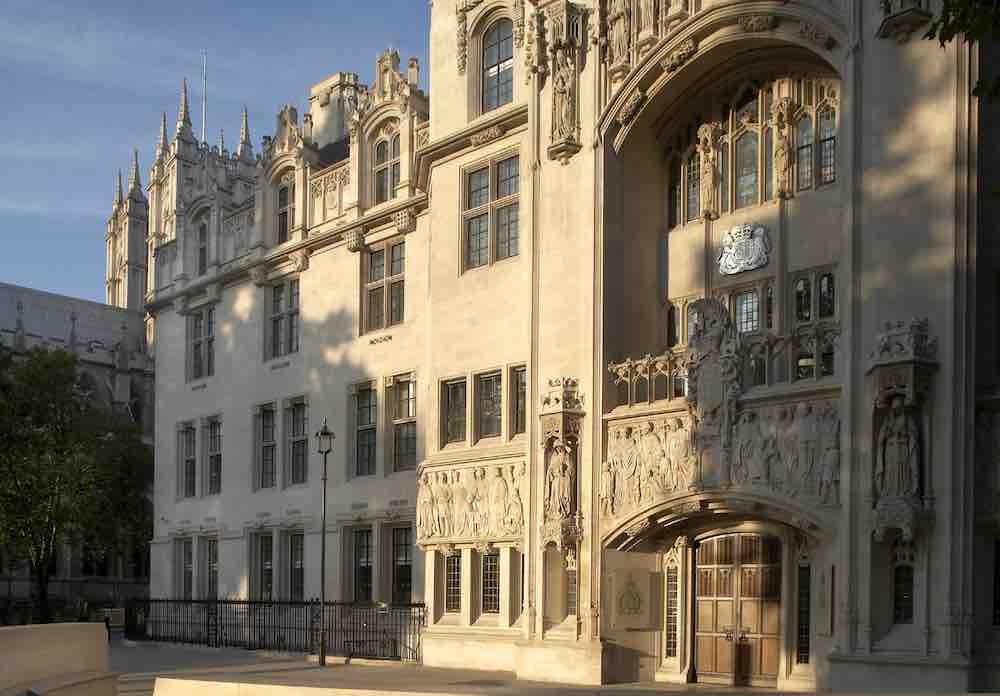

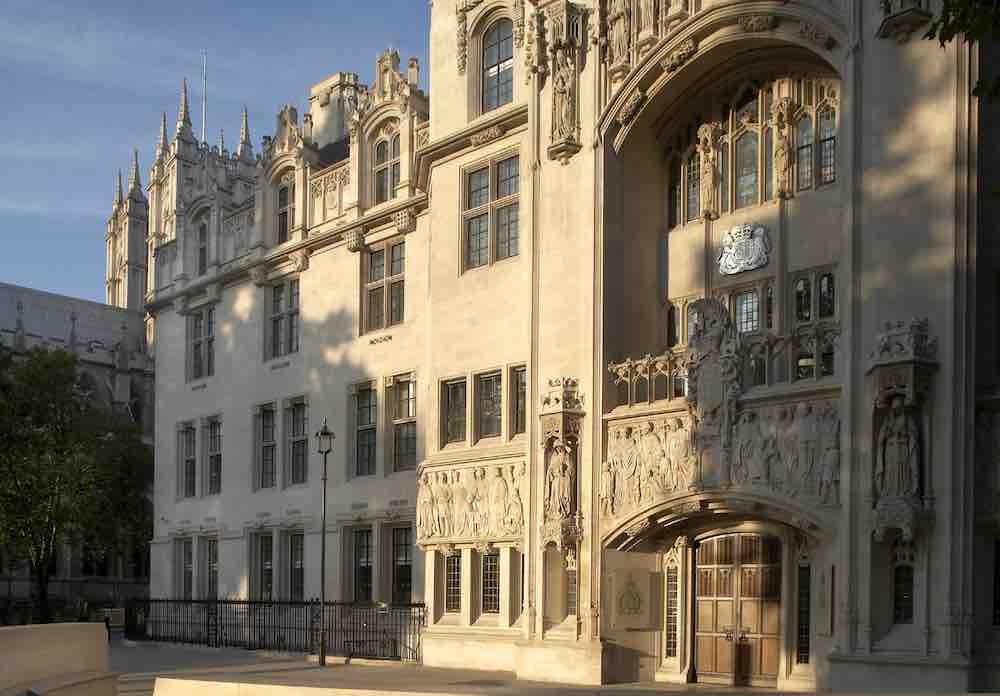

The Supreme Court has denied STM Group permission to appeal in the landmark Adams vs Carey case, effectively ending the long-running saga which questioned provider responsibility when accepting investments into a SIPP.

The appeal was denied this morning.

Some experts have warned that the judgment could spark £1bn of claims against SIPP firms

STM-owned Options (formerly Carey Pensions) had sought permission to appeal following a ruling from the Court of Appeal last year which ruled in favour of the claimant who had lost money after making a high-risk, unregulated investment through his SIPP.

The Supreme Court is the final court of appeal in the UK legal system, therefore the appeal denial is likely to end the long-running sage relating to an investment made in 2012.

The original case was heard in March 2018.

Last year the Court of Appeal unanimously overturned its previous ruling and found that Adams was advised by CLP Brokers, an unregulated introducer based in Spain. The court said that as CLP was not authorised by the Financial Conduct Authority to give investment advice, or make arrangements relating to investments, this was in contravention of the Financial Services and Markets Act 2000.

As the SIPP was entered into following advice given by CLP, the High Court declared that the SIPP agreement is unenforceable against Adams and he is entitled to recover money he paid into it, as well as compensation to reflect losses he suffered as a consequence.

STM acquired Carey UK Pensions LLP in February 2019.

In a statement this morning STM said: “A condition of the acquisition was the indemnity on any claims in the Adams v Carey case, with the benefit of significant existing PI cover held by the vendors. The decision therefore does not directly impact STM's exposure in this case, but it will have implications for the Financial Services industry more broadly.”