The top open market annuity could pay £662 more a year over a typical 20-year period than the worst-paying, according to Canada Life.

The difference would mean an extra £13,240 in income over two decades.

In reality, the difference between the best and worst deals in the market could be even bigger, Canada Life said, as many providers do not openly publish their annuity rates.

The figures are based on a pension pot of £150,0001.

Nick Flynn, retirement income director at Canada Life said: “Even in one of the straightforward scenarios, our calculations show the difference in income over a typical 20-year retirement can add up to thousands of pounds. That’s before you factor in health and lifestyle related questions, which can add additional income.

“With the considerable interest from customers seeking to capitalise on annuity rates where they are today, it might be easy to lose sight of some of the simple measures people can take to ensure they extract as much value from their pensions as possible.”

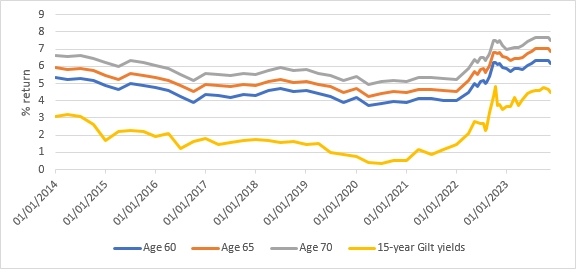

Today, a benchmark annuity for someone aged 65, with no pre-existing health or lifestyle conditions, would pay in the region of 7%, he said.

Canada Life said the annuity rate can increase significantly when disclosing common health or lifestyle conditions, such as diabetes, high blood pressure or being a smoker. Age can also have a big influence on the annuity rate offered.

• Source: Open market annuity rates taken from https://www.moneyhelper.org.uk/en/pensions-and-retirement/taking-your-pension/compare-annuities, based on a 65 year old, £150,000 purchase price, 10-year guarantee, no health or lifestyle factors. Rates as at 27.11.2023. In Canada Life’s example, the best quote would produce an annual income of £10,352, with the worst value paying £9,690, £662 a year less income. Over 20 years that would equate to £13,240 in less income.