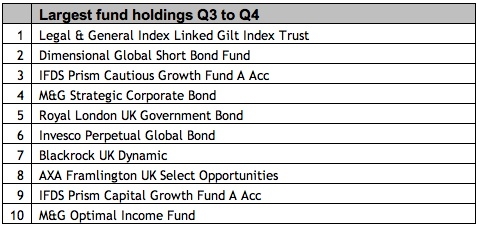

A Legal and General fund has become the largest fund on Nucleus, the adviser-owned wrap platform.

The Legal and General Index Linked Gilt Index Trust tracks the total return of UK government securities to provide an investment income.

A rise of 13 per cent in the final quarter of 2011 took the total fund holdings on the platform to just under £130m.

In second and third place was the Dimensional Global Short Bond Fund and the IFDS Prism Cautious Growth Fund A Acc respectively.

Two new entries to the top 10 largest fund holdings were AXA Framlington UK Select Opportunities in eighth place and M&G Optimal Income Fund in tenth place.

Kenny McKenzie, chairman of the Nucleus investment committee and managing director of wealth management firm Intelligent Capital, said: “The latest fund flow figures show that in the current climate, bond funds continue to be the investment of choice among Nucleus members and their clients.

“While statistics show this trend is replicated across the industry, what is interesting to note from these figures is that with over 3,500 funds available on the platform the two consistently largest are both index funds.”

Nucleus was founded in 2006 and is an adviser-owned and controlled online wrap based business platform.