Cash is still king of the ISA pack 20 years after the tax free accounts were introduced.

Investment ISAs have failed to set the public imagination alight although millions still use them and the amount invested is rising, according to analysis from Morningstar.

It is 20 years since the ISA predecessor Personal Equity Plans (PEPs) were transformed into Individual Savings Accounts which now come in a variety of types including Junior ISAs, Lifetime ISAs and Innovative Finance ISAs.

Key numbers are:

• Number of stocks and shares ISAs is hovering around 2.8m with little growth in past 10 years

• Actively managed funds up from 1,200 in 1999 to over 7,900 today

• Number of passive funds available has increased 45-fold

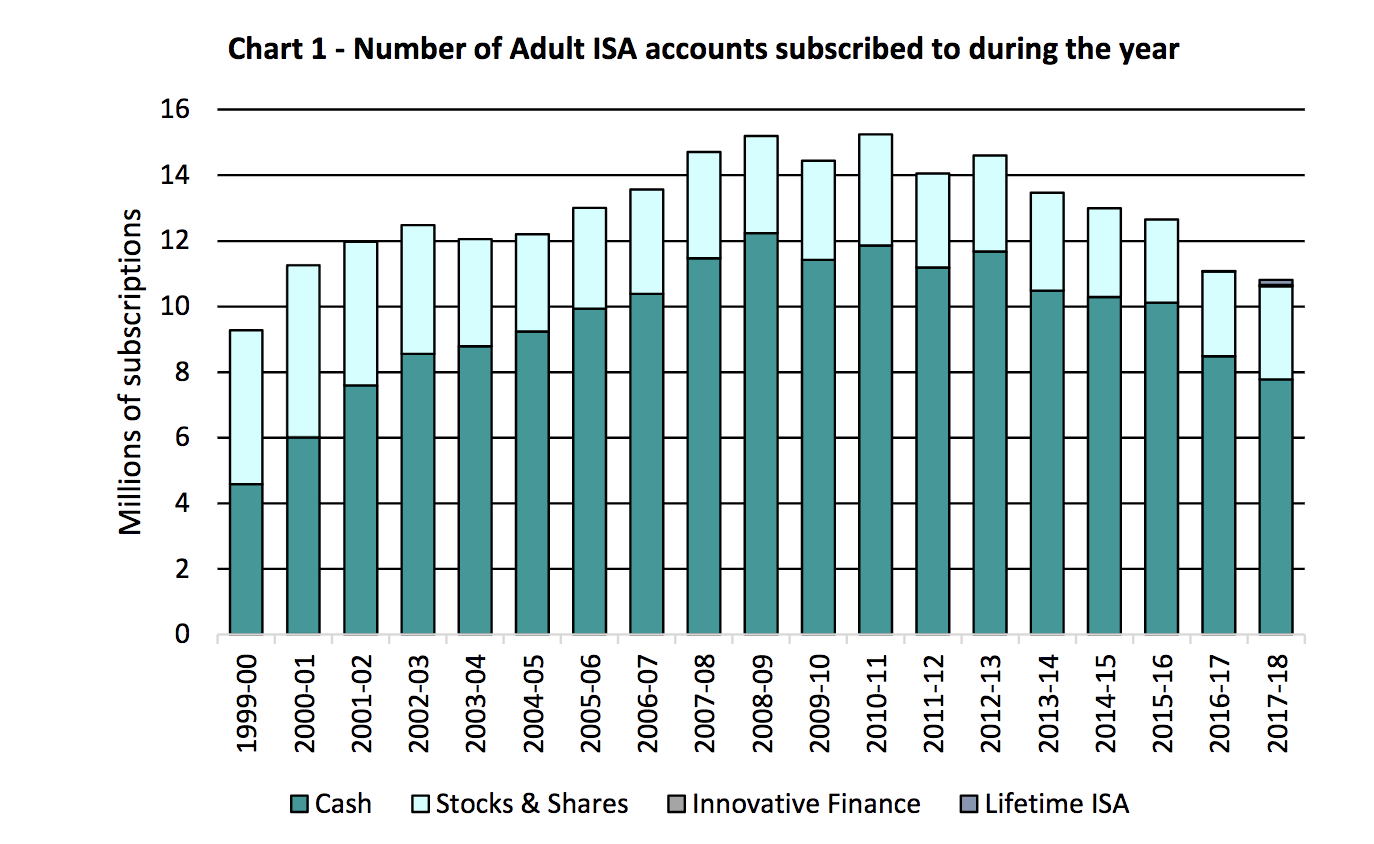

• Number of ISA accounts overall has been falling since global financial crisis of 2008

Morningstar says there is still a long way to go to persuade ‘ordinary people’ of the merits of investing via an ISA and the onus is on the investment industry to work harder to engage with consumers to persuade them not to rely just on cash.

Figures from ONS in 2018 show the total number of ISAs subscribed to fell from over 15m in 2008/9 to 10.8m in 2017/18. The number of stocks and shares ISAs fell from a peak of nearly 3.4m in 2010/11 to just over 2.8m in 2018/18.

On the positive side the total amount invested has risen in recent years to peak at £80bn in 2014/15, falling to £70bn 2017/18. The average invested or saved into an ISA has also risen, topping £6,000 in three of the last four years, double the amount seen in 1999.

Source: ONS

Ms Beard said ISAs have brought ‘simplicity’ to investing but investors still favour the Cash ISA.

She said: “The average subscription (in investment ISAs) has increased, but it’s likely the same people subscribing each year to take advantage of the tax-free allowance, given the fairly static number of accounts.

“The increase in passive funds is a staggering 45 times, and that’s without including ETFs; but that growth can be attributed to the Retail Distribution Review and unbundling of the cost of investment advice.

“While the fund industry has been creating ever more ways to tempt investors with their savings, it hasn’t really caught their imagination or interest in a significant way.

“The Cash ISA is still the preferred choice for a majority, even some 20 years on. ISA providers are offering interest rates that are significantly higher than the Bank of England base rate, with ease of withdrawal should that money be needed at short notice.

“We have a long way to go to convince ordinary people of the merits of investing through an ISA. There are a wealth of benefits of ISA investing – including tax-free savings, ability to contribute monthly, compounding returns growing portfolios. But the industry needs to work harder to educate consumers on these benefits.”