Passives-only managed portfolio service launched by AJ Bell

A passives-only managed portfolio service has been launched by AJ Bell.

The new MPS will have an annual management charge of 0.25% plus VAT.

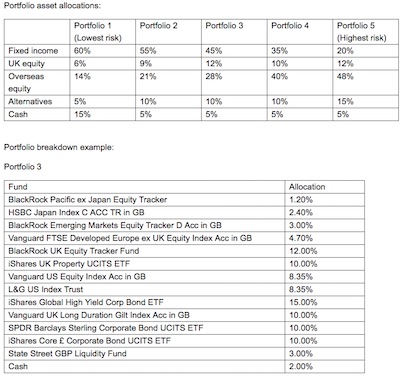

The portfolios are constructed from passive funds, with the aim being to keep total costs low, giving an ongoing charge figure for the constituents of each portfolio ranging from 0.18% to 0.22%. The total cost for the complete investment solution is between 0.48% and 0.52%, AJ Bell stated.

Billy Mackay, marketing director at AJ Bell, said the MPS makes it easy for advisers to offer their clients a comprehensive portfolio service without having to manage it themselves, freeing up their time.

It also helps them meet their regulatory obligation of ensuring the portfolios meet the needs of their clients, he said.

He said: “Advisers’ use of portfolio services has been on the increase since the RDR but the costs and transparency of traditional services have not kept pace with the direction of travel in the market.

“Our focus has been to build a managed portfolio service that is easy to understand for both advisers and their clients, fits into the existing business processes of advisers and offers their clients a competitive deal.”

There are five portfolios that target specific levels of risk, each of which have been mapped to the risk profiling tools from Distribution Technology and Finametrica with the aim to ensure advisers can incorporate them into their existing advice processes.

The portfolios will be run by AJ Bell Investments, the new investment management business that was created earlier this year. They are broadly diversified across asset classes and regions and will be rebalanced quarterly to ensure they remain aligned with their risk targets, officials added.