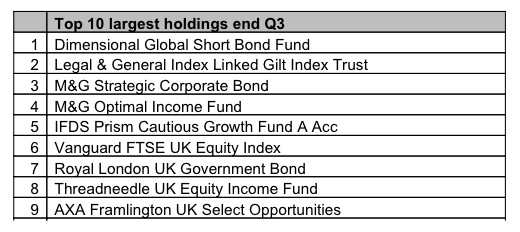

Platform provider Nucleus said that caution was again the watchword among advisers in Q3 as the Dimensional Global Short Bond Fund became the largest fund holding on Nucleus, replacing the Legal & General Index Linked Gilt Index Trust.

Assets in the £1.84bn Dimensional fund, which was launched in 2004 and invests in developed country Government Securities to provide an investment income, rose by more than 23% in the third quarter of 2012. This took the total held on the platform in this fund to just under £154m. Over the same period, the Legal & General Index Linked Gilt Index Trust saw assets fall by around 18%, reducing the total held on the platform to just under £130m.

Of the other funds that make up the top 10, Vanguard's FTSE UK Equity Index Fund was the only new entrant, having come in the top three funds in terms of value increase.

Kenny McKenzie of the Nucleus IFA Advisory Board and partner of SAM Wealth LLP, said: "Caution remains very much the watchword for investors as we move into the last quarter of the year and this can be clearly seen in the latest fund flow figures. What can also be clearly seen is the popularity among member firms of index funds, and in particular Dimensional's Global Short Bond Fund, which despite being the largest fund holding on Nucleus isn't available on many other platforms."