Salary expectations in the Financial Planning profession are climbing after the sector experienced notable growth last year - but nearly half of professionals say they are still undervalued.

Recruitment firm Recruit UK surveyed the profession at the end of 2024 and found strong growth in salaries but nearly 1 in 2 Financial Planning professionals believe they are worth more.

Emily Dalton, marketing manager at Recruit UK, said salaries and packages showed strong growth in 2024 but many professionals surveyed believe their true worth has yet to be reflected in their earnings.

She said: “Based on our data collection, despite growth, nearly half of the Financial Planning professionals we asked feel their salaries don’t fully reflect their skills. Regular salary reviews and transparent communication with management are critical to bridging this gap and ensuring your worth is recognised.”

Planners are interested in more than just the salary they may be offered, she said, according to the survey, with job satisfaction an important factor.

Salaries can vary widely across different skills with Paraplanners doing particularly well in recent years.

Paraplanners, can now expect to receive up to £55,000 per annum while administration roles are paying up to £40,000, according to data from Recruit UK. Basic salaries for Financial Planners are often north of £60,000. Salaries of £80,000 to £100,000 are not uncommon.

The survey said: "The Financial Planning sector saw notable growth in 2024, pushing salary expectations upward across the UK. Firms are responding with robust compensation packages that include competitive salaries, comprehensive benefits, and structured career development pathways."

Salaries vary significantly by region, reflecting local economic conditions and demand, the firm pointed out.

For instance, while London Paraplanners can expect to be offered £45,000 to £55,000, in the North East salaries offered are nearer to the £32,000 to £42,000 range. Administration roles show similar geographical differences, with London salaries offered ranging from £32,000 to £40,000, while in Wales they sit between £25,000 and £30,000.

Salary is not everything, however. Many Financial Planners also want a supportive culture, strong leadership, and a respected reputation to help foster a sense of purpose and security. Modern IT tools, admin support, and flexible working enhance efficiency and balance, they say.

Ms Dalton said: “Add in career development opportunities, and it’s clear from what we’ve seen that satisfaction thrives when firms empower Financial Planners to excel for clients, value their expertise, and cultivate an ethical, growth-focused environment where they feel motivated and fulfilled.”

The survey also showed that more than a quarter, 27%, of professionals prioritise work-life balance over salary, underscoring the need for firms to refine hybrid policies.

Ms Dalton said: “Despite some firms nudging staff back to the office, flexibility is a key differentiator in attracting and retaining talent.”

The report considered the impact of AI on Financial Planning and concluded that AI and technology are already transforming the UK Financial Planning landscape, particularly on the operational side. Paraplanners, for instance, benefit from AI-driven tools that automate data analysis and streamline workflows, allowing more time for strategic tasks, Recruit UK said. CRM systems and advanced planning software are now staples in many firms, enhancing efficiency and client service.

Looking ahead she said Financial Planners should expect steady rises in salaries offered as firms compete for top talent with competitive packages. She predicted that flexible arrangements will remain central, with firms balancing home and office models or compensating for increased office time.

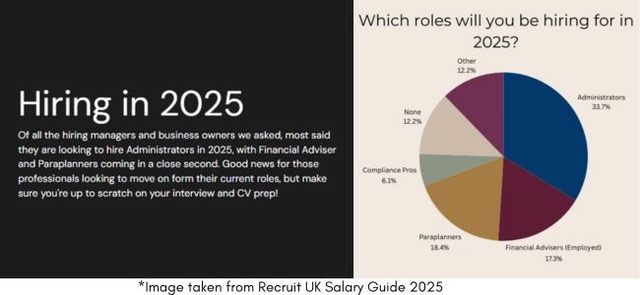

Recruit UK surveyed hundreds of Financial Planning professionals, alongside directors and hiring managers, to provide "a robust, firsthand view of the UK market."

• Financial Planning Today has its own jobs hub. Click on 'Jobs' on the home page.

• A full version of Emily Dalton’s article about the data will be published in the next issue of Financial Planning Today magazine in May.