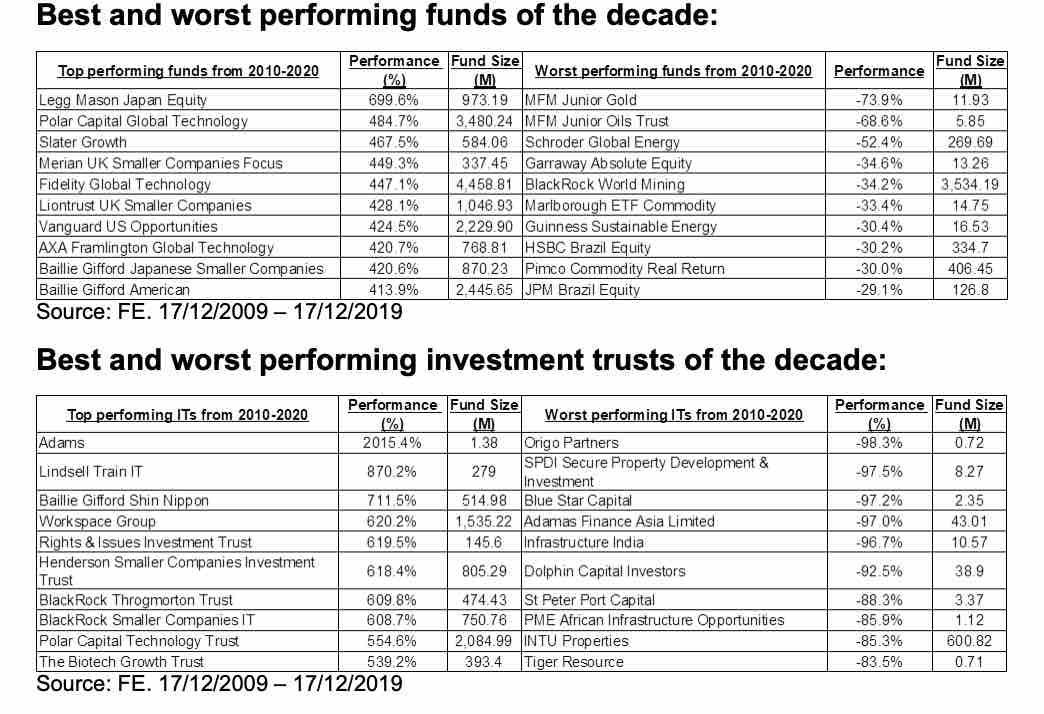

A Japanese fund - Legg Mason Japan Equity - has topped the best performing funds over the past decade but the best performers were a mixed bag with no single sector dominating.

The Legg Mason fund provided a return of nearly 700% for investors over the past 10 years, however this fund was one of the worst performers in the previous decade.

Platform and SIPP provider AJ Bell has analysed the performance of the best and worst performing funds and investment trusts over the past decade as we prepare to leave enter the 2020s.

The funds are mixed but AJ Bell says that if there is one better performing sector it is Japanese Smaller Companies, the “stand out” over the decade.

Ryan Hughes, head of active portfolios at AJ Bell, said: “Looking at mainstream investments, Japanese smaller companies have been the stand out area over the decade with the Legg Mason Japan Equity fund, managed by Hideo Shiozumi, leading the tables, growing by nearly 700% over the last ten years.

“Interestingly, a look back at the previous decade shows us that this very same fund was the second worst performer of that decade showing just how things have changed as quantitative easing has driven markets higher.

“The last decade feels like a transformative period for technology and it is therefore unsurprising that technology funds feature heavily in the best performers. Polar Cap Global Technology has led the way, helped by its high quality management team, and other technology funds have also made the top ten. With so much of the US market driven by technology, US equity funds also made the top ten with Baillie Gifford American clearly capitalising on its growth style.

“The other clear theme of the decade is UK smaller companies with Slater, Merian and Liontrust all showing their stock picking prowess over a long period.”

The worst performing fund was MFM Junior Gold which which lost investors nearly 74% of their money.

Among investment trusts, Adams was best with a return of over 2,000% and Lindsell Train IT second with a return of 870%. Bottom was Origo Partners which lost investors 98% of their money.

Mr Hughes said: “After being the top performer of the previous decade, commodities have certainly struggled over the last ten years with gold, oil and other commodity funds all taking a pounding. The reliance of commodities on the Brazilian market also meant that country specific funds made the list of shame with HSBC and Pictet both seeing their Brazil funds at the bottom of the charts.

“Away from commodities, the Garraway Absolute Return fund delivered anything but this, with a fall of nearly 35% making it a miserable decade for long term investors.”

Looking at investment trusts he said: “The last ten years have been a dream for Lindsell Train as their quality growth style has absolutely dominated. This has propelled the Lindsell Train investment trust to the top of the tables with returns of a remarkable 870%.

“Unsurprisingly, the themes seen in open ended funds have been replicated in investment trusts with Japanese smaller companies, UK smaller companies and technology all performing strongly. Honourable mentions should go to the likes of Baillie Gifford, Henderson and BlackRock amongst others for delivering huge returns for investors.”

Looking at the worst performing investment trusts he said: “While no obvious theme persists, the appearance of the India Infrastructure Trust and African Infrastructure Opportunities showing huge losses shows just how hard it can be to make money in high risk markets such as these.”