Wealth manager St James’s Place has reported a slowdown in new client investment as the impact of Covid-19 hits investor confidence.

In a business update today, the company confirmed a slowdown but said it was showing “continued resilience in a challenging environment.”

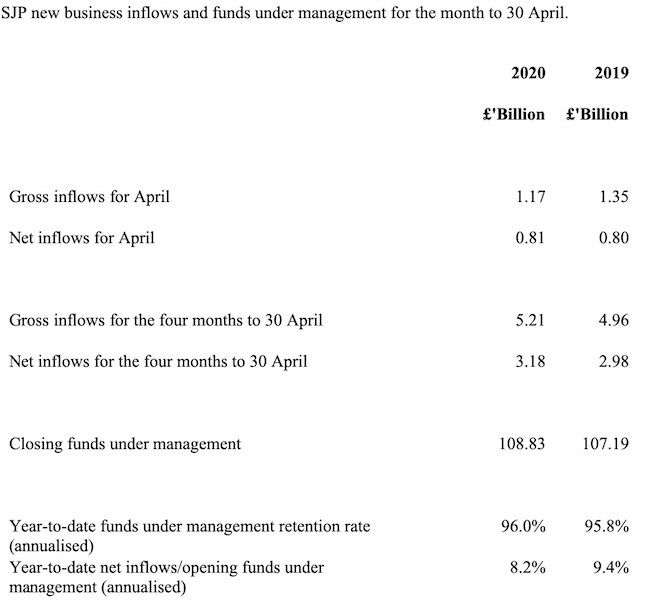

April gross inflows at £1.17bn were 13% lower than a year ago when they reached £1.35bn as clients avoided topping up investments or making new investments.

However net inflows were just 1% lower as many existing long term clients kept invested despite market volatility.

Total funds under management were boosted by a recent pick up in stock markets and rose from £107.19bn a year ago to £108.83bn in April.

The company, one of the UK’s largest wealth managers with more than 4,000 advisers, will be providing ad hoc business updates this month and in May and June

Andrew Croft, chief executive, said: "Following record first quarter new business, we have naturally seen a reduction in new investments as the Covid-19 crisis developed.

“In light of the need to observe social distancing, the partnership has quickly adapted to managing client relationships 'virtually' and April gross inflows were robust, albeit 13% lower than the same month last year.

“Retention of client investments was particularly strong during the month and as a result, April net inflows were 1% higher than a year ago. Funds under management benefitted from both positive net inflows and a positive investment return, to end the month at £108.8 billion.

“We are encouraged by the robust gross and net inflows we have continued to experience during May, though the short to medium-term impact of government measures and economic volatility on our flows remains uncertain."

Source: SJP