Thursday, 05 July 2012 10:59

Tracker funds "most popular funds" on Alliance Trust Platform

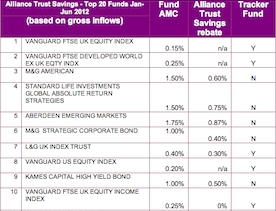

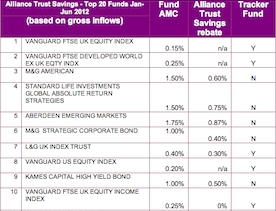

Alliance Trust Savings has published the 20 most popular funds purchased on its i.nvest platform during the first half of 2012. Five of the top ten funds are tracker funds.

The Alliance Trust Savings platform offers over 1,500 funds, the majority of which have no initial charge and any fund commissions received from fund managers are fully rebated directly to the customer’s account.

The top 20 list of most popular funds illustrates the diversity of funds available through the i.nvest platform with results clearly showing the current popularity of low-cost tracker funds with low Annual Management Charges (AMCs). In particular, Vanguard funds with AMCs as low as 0.15% are very popular, occupying four of the top ten positions on the funds list.

Alliance Trust Savings is one of the few platform providers able to offer customers access to low cost tracker funds that pay no rebates, as unlike many other platforms, they are not reliant on rebates as a source of revenue. The full range of funds on the i.nvest platform is available across Alliance Trust Savings’ ISA, SIPP and dealing accounts.

Garry Mcluckie, marketing director at Alliance Trust Savings, said: “The latest list of most popular funds on our platform shows just how attractive low cost funds currently are to investors.

“Another aspect highlighted by the list of top 20 funds purchased in the first half of 2012 is the diversity and range of investment options on our platform, from low cost trackers to funds that give exposure to bonds, emerging markets, North America or Asia. Our customers have shown a real appetite for income bond funds in particular. The low AMCs on trackers and fund rebates on other funds combined with Alliance Trust Savings’ competitive dealing charges mean that advisers and investors can minimise charges and maximise potential returns.

“Alliance Trust Savings is ahead of the game with regards to the upcoming Retail Distribution Review and is well positioned following the recent confirmation that the FSA intends to ban cash rebate payments. We have never relied on rebates from fund providers as a source of revenue. Our model of charging a flat rate fee for our administration will remain while others are likely to replace lost revenue with a percentage based administration.”

The Alliance Trust Savings platform offers over 1,500 funds, the majority of which have no initial charge and any fund commissions received from fund managers are fully rebated directly to the customer’s account.

The top 20 list of most popular funds illustrates the diversity of funds available through the i.nvest platform with results clearly showing the current popularity of low-cost tracker funds with low Annual Management Charges (AMCs). In particular, Vanguard funds with AMCs as low as 0.15% are very popular, occupying four of the top ten positions on the funds list.

Alliance Trust Savings is one of the few platform providers able to offer customers access to low cost tracker funds that pay no rebates, as unlike many other platforms, they are not reliant on rebates as a source of revenue. The full range of funds on the i.nvest platform is available across Alliance Trust Savings’ ISA, SIPP and dealing accounts.

Garry Mcluckie, marketing director at Alliance Trust Savings, said: “The latest list of most popular funds on our platform shows just how attractive low cost funds currently are to investors.

“Another aspect highlighted by the list of top 20 funds purchased in the first half of 2012 is the diversity and range of investment options on our platform, from low cost trackers to funds that give exposure to bonds, emerging markets, North America or Asia. Our customers have shown a real appetite for income bond funds in particular. The low AMCs on trackers and fund rebates on other funds combined with Alliance Trust Savings’ competitive dealing charges mean that advisers and investors can minimise charges and maximise potential returns.

“Alliance Trust Savings is ahead of the game with regards to the upcoming Retail Distribution Review and is well positioned following the recent confirmation that the FSA intends to ban cash rebate payments. We have never relied on rebates from fund providers as a source of revenue. Our model of charging a flat rate fee for our administration will remain while others are likely to replace lost revenue with a percentage based administration.”

This page is available to subscribers. Click here to sign in or get access.