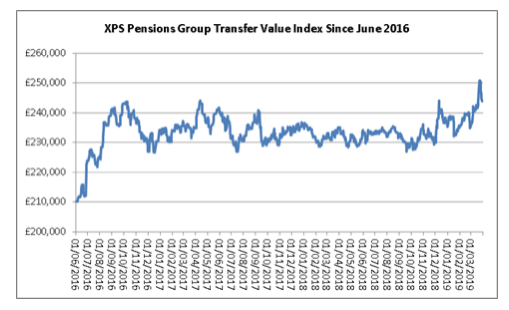

Pension transfer values as measured by the XPS Pensions Group Transfer Value Index increased “substantially” during March, the firm has said.

They peaked at almost £251,000 before losing some of those increases to end March at £244,900, an increase of £9,700 on the previous month end.

The difference between maximum and minimum readings of the XPS Pensions Group Transfer Value Index over March 2019 was £15,600 (or around 6.2%).

XPS says it is “notable” that these figures represent the highest intra-month peak, the highest month end, and the largest monthly fluctuation, recorded since the inception of the index in April 2015.

Over the quarter, the index has increased by £9,700 with the difference between maximum and minimum readings being £18,700 (or around 7.5%).

Sankar Mahalingham, head of DB Growth, XPS Pensions Group, said: “The movements in the transfer value index during March were largely driven by gilt yields, which fell by as much as 0.35%, and ended the month around 0.3% down.

“Inflation also increased by as much as 0.15% but ended the month unchanged from the previous month end.

“Gilt yields were observed to drop markedly during the period from 19-22 March, around the same time as debate and votes in the House of Commons led to a change in the proposed Brexit date.

“It is likely that further Brexit-related developments will continue to drive market movements for the foreseeable future.”

The XPS Pensions Group Transfer Value Index tracks the transfer value that would be provided by an example DB scheme to a member aged 64 who is currently entitled to a pension of £10,000 each year starting at age 65 (increasing each year in line with inflation).

Different schemes calculate transfer values in different ways.

A given individual may therefore receive a transfer value from their scheme that is significantly different from that quoted by the XPS Pensions Group Transfer Value Index.