UK equity funds experience £1.2bn outflow

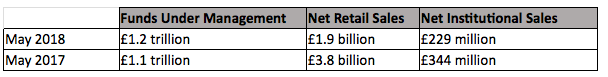

The Investment Association’s monthly statistics of UK investor behaviour in May 2018 showed outflows from UK equity funds reached £1.2bn in May.

other headline figures revealed included an additional £1.9bn invested into UK authorised funds, and funds under management totalling £1.2trn.

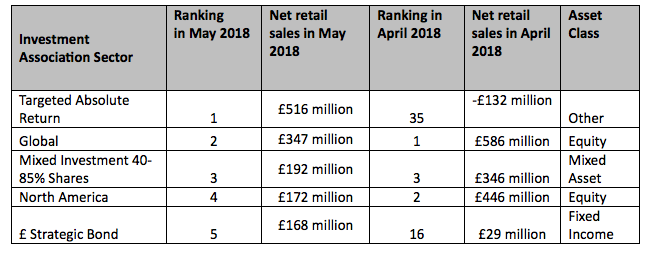

Targeted Absolute Return was the best-selling sector in May with £516m net retails sales, the statistics showed.

The statistics showed the five fund platforms that provide data to The Investment Association (Aegon, Fidelity, Hargreaves Lansdown, Old Mutual Wealth and Transact) saw net retail sales of £646m in May.

Personal pensions had net sales of £562m, ISAs £214m, insurance bonds £5m, while unwrapped saw a net outflow of £135m.

For the same five fund platforms, funds under management as at the end of May 2018 were £278 bn, compared with £249bn a year earlier.

Chris Cummings, chief executive of the Investment Association, said: “In the context of ongoing Brexit uncertainty, outflows from UK equity funds reached £1.2bn in May.

“As the clock ticks towards the UK leaving the EU, we need to see a gear change ahead of the next European Council Summit in October and significant progress being made towards a deal that will protect the wider European economy.”

Alastair Wainwright, fund market specialist of the Investment Association, said: “UK equities have been unpopular with UK investors since the beginning of January 2016, however outflows increased following the Brexit referendum result.

“However, UK equities are not necessarily reflective of the UK economy, given the high number of firms with international revenue bases listed in London.”

May also saw outflows from the sterling corporate bond and high yield bond sectors, but inflows into the sterling strategic bond sector increased

Within the strategic bond sector there were higher flows into funds with a global investment strategy and lower inflows into funds with high UK exposure.

Mr Wainwright added: “May also saw the resurfacing of Targeted Absolute Return as the best-selling sector.

“This signals caution amongst investors as they look to insulate themselves from market movements in the traditional equity and fixed income markets.”