UK investors are turning away from ESG investments due to the pressures of the cost-of-living crisis, according to a new report.

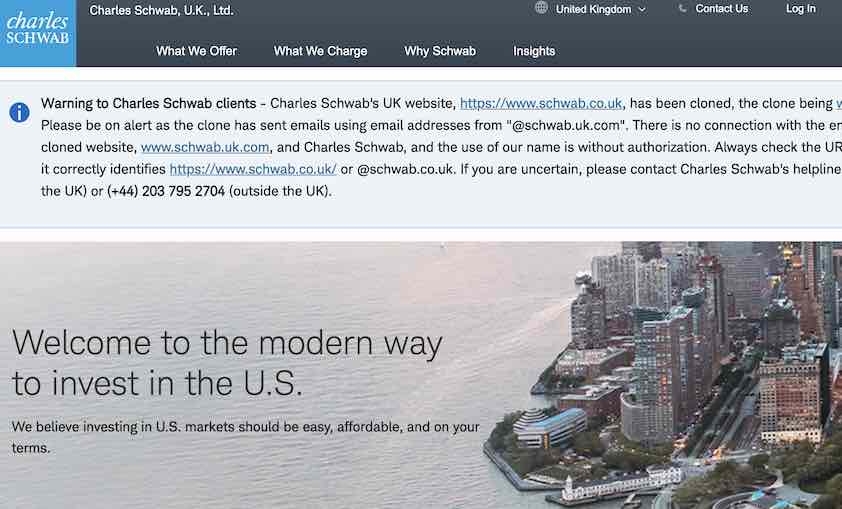

Two thirds (67%) of UK investors surveyed by investment provider Charles Schwab said they now prioritised maximising returns over choosing sustainable investments.

This compares to 2021 when over half (55%) of the investors surveyed prioritised ESG investments, regardless of whether they underperformed.

Over the two-year period, the number of investors who believe companies with strong ESG credentials are attractive investment options has dropped by 7%, from 75% to 68%.

The number of investors who consider ESG when making new investments also dropped, down 6% since December 2021 to 38%.

Boomer investors are the least likely to take ESG factors into consideration when investing (23%), followed by Gen X investors (32%), Millennials (49%) and Gen Z investors (50%).

The belief that ESG investments provide good returns has also taken a hit, with 65% of those surveyed recently thinking they yield better returns, as opposed to 71% in December 2021.

Willingness to pay additional fees for sustainable investments decreased by 8%, with only half of investors willing to take on additional charges.

Richard Flynn, managing director for Charles Schwab UK, said: “With the need to maximise returns seemingly growing in importance amid the cost-of-living crisis, fewer investors seem to be factoring in ESG-related considerations into their investment decisions.

"The return on investment is increasingly being called into question, with the fees often associated with sustainable investments now actively discouraging investors in this current climate. It will be interesting to see how any economic rebound and reduction in inflation impacts this attitude in the coming years.”

• Charles Schwab surveyed 1,000 UK investors in December.