Fintech firm Wealth Wizards has launched financial wellbeing software to help financial advisers improve their retirement prospects.

The Turo Wellbeing software guides consumers through wellbeing questions, content and offers a personal recommendation on an automated basis.

The questions cover nine different areas of wellbeing to personalise the journey. The software encourages clients to ‘play’ with the resources and take action to improve their financial wellbeing.

Mark Kiddell, chief commercial officer at Wealth Wizards, said: “Having control over our finances and a clear plan to achieve our financial goals is essential for financial wellbeing and has a direct correlation with our mental and physical wellbeing.

“We know from experience that consumers want easily accessible financial help and support, whether that’s guided outcomes, digital advice with some human oversight, or fully fledged regulated advice. One of the valuable benefits of Turo Wellbeing is that it can offer both guidance and access to advice – via consumer-led and human-assisted (hybrid) experiences – depending on the consumer’s needs.

“At a time of financial and economic turbulence, we’re aiming to help as many people as possible manage their money more effectively for themselves and their families during the current cost of living crisis and beyond.”

Parent company Royal London is using the wellbeing software to create a series of personalised 'journeys' for customers to improve their financial wellbeing and retirement prospects, through a guidance-only pathway.

Royal London acquired Wealth Wizards in March 2021.

Wealth Wizards’ proposition can automate key parts of the advice process and offer clients a digital interface.

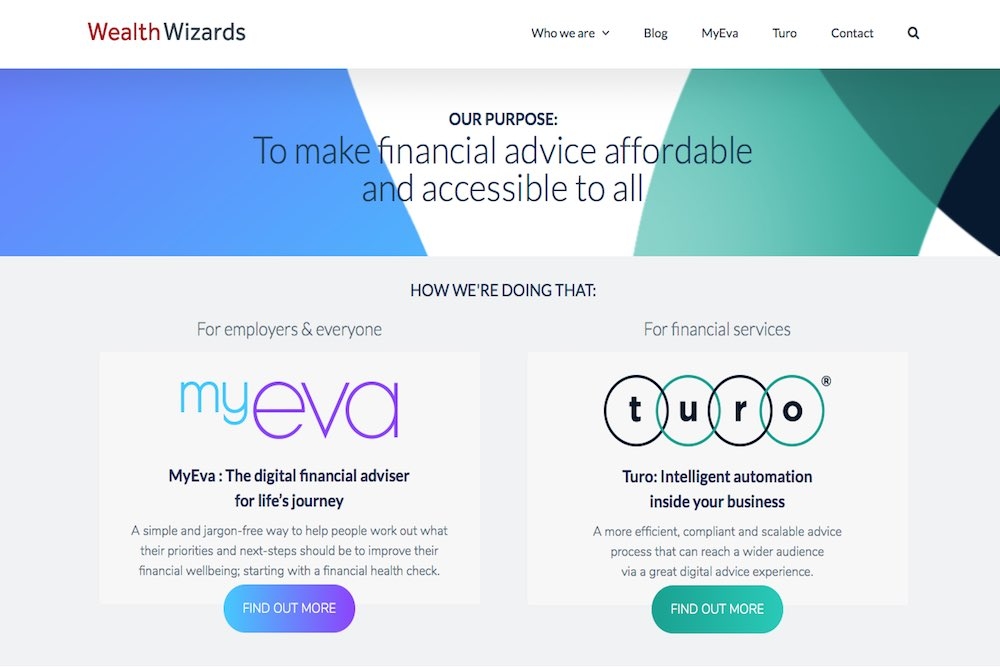

The Leamington Spa-based firm was established in 2009 with the goal of making financial advice accessible to all. It launched a regulated digital independent financial adviser, available to users via employers, in July 2019.

Wealth Wizards works with Financial Planners, other financial services organisations and with employers via a single platform that combines machine learning and artificial intelligence with technology.