Wednesday, 30 January 2013 10:55

PPI sees complaints to the Ombudsman soar to record levels

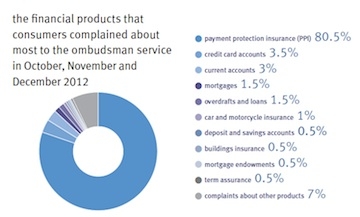

Total complaints received by the Financial Ombudsman Service increased by 75 per cent in the three months to the end of 2012.

In an Ombudsman newsletter, it said it had received 180,679 complaints during the period, up from 103,197 in the previous quarter.

This meant the Ombudsman received more complaints in this quarter alone than any single year between 2000 and 2010.

Some 80 per cent of these complaints related to payment protection insurance, up 65 per cent on the previous quarter.

Over 244, 873 PPI complaints have been received during the 2012/13 financial year so far, up from 157, 716 in the entire 2011/12 financial year.

{desktop}{/desktop}{mobile}{/mobile}

The second highest sector the Ombudsman received complaints about was credit card accounts which accounted for 3.5 per cent of total complaints. Some 15,433 have been received so far while 18,977 were received during 2011/12.

Chief executive of the Ombudsman Natalie Ceeney said she expected the high number of complaints to continue. She said this posed a problem for the Ombudsman as it was trying to build capacity for the higher workload as well as deal with the cases themselves.

She said: "Consumers have referred significantly more cases to us in the current financial year than any of us had forecast. Much, but not all, of this increase has been in PPI cases. This has meant that 2012/13 has been particularly challenging for us.

"This challenge shows no sign of abating. Many businesses are still reporting sustained high volumes of complaints and are themselves working on the assumption that this will continue in the immediately foreseeable future."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.

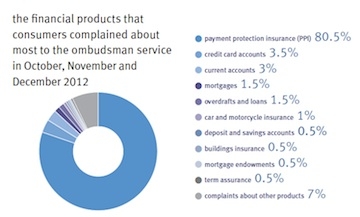

In an Ombudsman newsletter, it said it had received 180,679 complaints during the period, up from 103,197 in the previous quarter.

This meant the Ombudsman received more complaints in this quarter alone than any single year between 2000 and 2010.

Some 80 per cent of these complaints related to payment protection insurance, up 65 per cent on the previous quarter.

Over 244, 873 PPI complaints have been received during the 2012/13 financial year so far, up from 157, 716 in the entire 2011/12 financial year.

{desktop}{/desktop}{mobile}{/mobile}

The second highest sector the Ombudsman received complaints about was credit card accounts which accounted for 3.5 per cent of total complaints. Some 15,433 have been received so far while 18,977 were received during 2011/12.

Chief executive of the Ombudsman Natalie Ceeney said she expected the high number of complaints to continue. She said this posed a problem for the Ombudsman as it was trying to build capacity for the higher workload as well as deal with the cases themselves.

She said: "Consumers have referred significantly more cases to us in the current financial year than any of us had forecast. Much, but not all, of this increase has been in PPI cases. This has meant that 2012/13 has been particularly challenging for us.

"This challenge shows no sign of abating. Many businesses are still reporting sustained high volumes of complaints and are themselves working on the assumption that this will continue in the immediately foreseeable future."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.

This page is available to subscribers. Click here to sign in or get access.