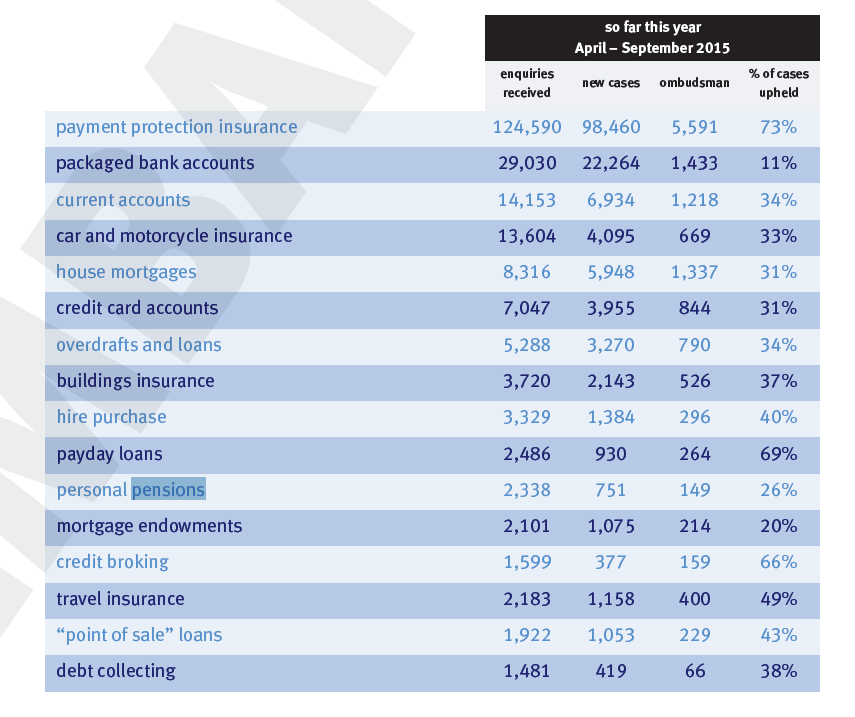

Pensions came outside of the top ten most complained about products in the latest Financial Ombudsman tables.

Personal pensions were only eleventh in the list, with 2,338 enquires received by the FOS from April to September.

These resulted in 751 cases, 149 of which went to the Ombudsman for a decision. The proportion of cases upheld was 26%.

Occupational pension transfers and opt-outs were a long way down the table with 326 enquires received by the FOS, leading to 230 taken on as cases, 79 going to the Ombudsman and 32% were upheld.

There were 109 enquires received by the FOS on OEICs (open-ended investment companies), leading to 91 taken on as cases, 16 going to the Ombudsman and 42% were upheld.

There were 91 enquires received by the FOS on premium bonds, leading to 36 taken on as cases, 5 going to the Ombudsman and 34% were upheld.

An overall summary of the latest quarter’s data from the FOS showed that during July, August and September:

• It handled 141,622 enquiries from consumers, taking on 85,896 new cases

• 9,715 complaints passed to an ombudsman as the final stage of the complaints

handling process.

• PPI remained the most complained about financial product, with 49,672 new cases in the second quarter.

• Packaged bank accounts were the second most complained about product, with 10,163 new cases – slightly down from the previous quarter.

• The proportion of complaints upheld in favour of consumers was 51% - ranging from 3% (for complaints about SERPs) to 72% (for complaints about PPI).