The latest ISA season failed to live up to last year, with less than half of the end of tax year subscriptions compared to 2015, figures show.

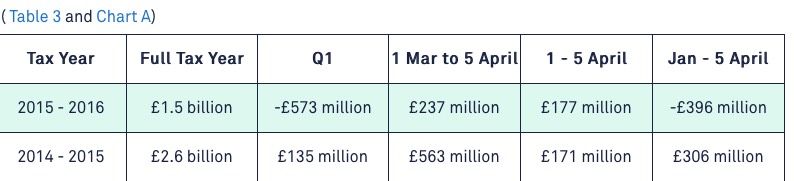

The Investment Association’s data showed that £237 million was subscribed to stocks and shares ISAs between 1 March and 5 April, compared with £563 million the year before.

But the usual late rush into ISAs in the final week of the tax year was seen again, with net ISA sales of £177 million, up from £171 million in the same week last year.

During the 2015/16 tax year, funds in ISAs provided by fund companies and the five fund platforms that feed data to The Investment Association (Cofunds, Fidelity, Hargreaves Lansdown, Old Mutual Wealth and Transact) saw a net inflow of £1.5 billion, down from £2.6 billion the year before.

Laith Khalaf, senior analyst at Hargreaves Lansdown, said: “The ISA season a looks like a bit of a damp squib for the industry as a whole when compared to last year. Indeed across the entire tax year, investors put £1.1 billion less in Stocks and Shares ISAs than they did in the previous tax year.

“That is almost certainly partly attributable to risk aversion, as markets have fallen off their perch since the record high achieved last April, testament to this is the recent popularity of Absolute Return funds, which were the best-selling sector in March.

“However pension sales appear to have held up quite well so far this year, which might suggest investors have prioritised their Sipps over their ISAs. Perhaps this is down to pension freedoms making pension saving look more attractive, or it could be higher rate taxpayers making hay while the sun is shining, in the expectation that sooner or later their tax relief might get cut.”

The association reported that the top three best-selling sectors for ISAs based on the five fund platforms in March 2016 were:

1. UK Equity Income (£86 million net sales)

2. Asia Pacific Excluding Japan (£49 million net sales)

3. Mixed Investment 40-85% Shares (£29 million net sales)

Guy Sears, Interim Chief Executive of the Investment Association, said:

“Retail sales turned positive in March as investors sought to make the most of their pension contribution and ISA allowances ahead of the end of the tax year.

“Retail investors remained cautious and reduced their holdings in equity funds, looking instead to multi-asset, absolute return and fixed income products. It is a sign of the times, with changing pension regulation and uncertainty in the global economic outlook, that multi-asset and absolute return products have been popular with retail investors."