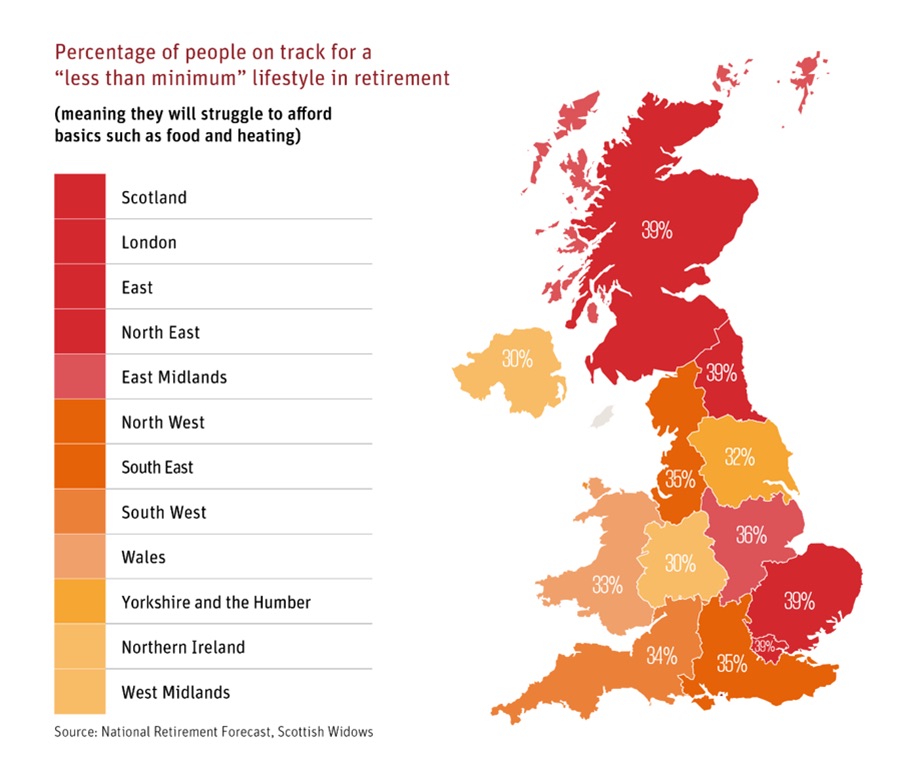

London is among the worst UK regions for predicted post-retirement financial struggle, a new study by Scottish Widows has predicted, writes Emily Berry.

According to the study, nearly four in 10 retirees in London, Scotland, the North East and East of England will struggle to meet minimum living costs in retirement.

The study suggests 39% of Londoners are on track for ‘less than the minimum’ retirement income. Scottish Widows says this group of impoverished pensioners will struggle to afford basic essentials such as food and heating.

The forecasts are made in the pension provider’s latest National Retirement Forecast Study, launched to support of a campaign by the Pension and Lifetime Savings Association trade body (PLSA) this autumn to raise awareness of the looming pension crisis facing many in retirement.

Scottish Widows: National Retirement Forecast Study Sept 2023 / regional forecasts

The Pension and Lifetime Savings Association (PLSA) defines the ‘minimum income’ needed for a single pensioner in retirement as £12,800. Pensioners should target an income of £23,300 per annum for a moderate retirement and £37,300 for a comfortable income, according to PLSA estimates.

Apart from London, other UK regions where retirees are set to fail to reach the minimum income in retirement are Scotland, the North East and East of England with 39% of retirees expected to receive less than the minimum retirement income needed when they retire.

Northern Ireland and the West Midlands had the lowest figure of retirees facing less than minimum required pensions but even here 30% of people were facing poverty in retirement.

The study also found that Londoners were also the most likely to rent their homes than anywhere in the UK, with 35% renting. Based on the forecasts, London ‘minimum income’ retirees are likely to see rental payments consuming 131% of their retirement income, a UK high. Even in the East of England, where rents are lower, retirees who rent will find 98% of their money consumed by rental costs if they are on minimum retirement income.

Scottish Widows is advising workers to save at least 15% of their salary including employer contributions and tax relief for their pension, in order to have a decent retirement lifestyle.

The study has been launched as part of the PLSA’s Pension Engagement Season campaign encouraging pension savers to take a serious look at their projected retirement income.

Peter Glancy, head of policy at Scottish Widows, said: “The uncomfortable truth is that people across the UK are not managing to save enough for retirement and some continue to go along unaware when they could be taking some simple steps to make a big difference to their financial future.”