As stakeholder pensions are set to reach 18 years old Hargreaves Lansdown has revealed six out of the biggest 10 funds have underperformed.

Despite their performance stakeholder pensions remain popular with two million people still paying in £3.18bn a year.

However popularity appeared to have peaked in 2007/8 when £3.92bn was deposited.

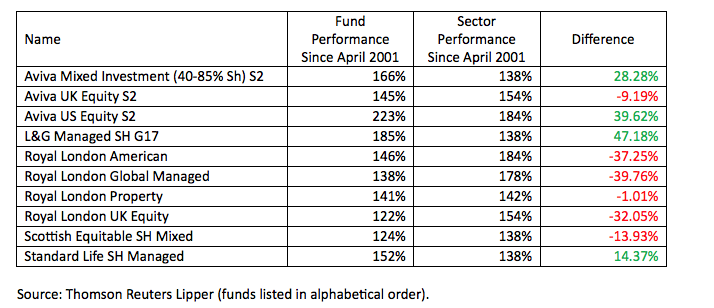

Hargreaves Lansdown produced the table below to show the performance of the 10 biggest funds since 2001.

Nathan Long, senior analyst at Hargreaves Lansdown, said: “Auto-enrolment is destined to be the undisputed saviour of retirement saving, but 18 years ago stakeholder pensions laid the foundations of today’s success.

“Stakeholder pensions attracted yearly contributions of nearly £4bn at their peak, despite many people considering them a flop.

“Today we continue to see over £3bn contributed each year.

“Despite their failure to properly resolve the retirement savings crisis, stakeholder pensions performed the valuable job of dragging down pension charges to more consumer-friendly levels, but they’ve failed to move with the times and now look the poorer cousin of modern day pensions that offer access to the best investments, online or in some cases through our mobile phones.

“The largest funds have delivered below par returns making it all the more surprising that contributions continue to pour in.

“It’s remarkable that advisers are still required to justify their pension recommendations in comparison to the old style products.”