Close to 7 in 10 (68%) of financial advice clients are over the age of 50, according to a new report.

Those in their 40s made up 14% of clients, with under 30s accounting for just 4% of the advised population.

Married men over 50 years old account for one in five consumers receiving financial advice in the UK, according to the report from fintech Intelliflo.

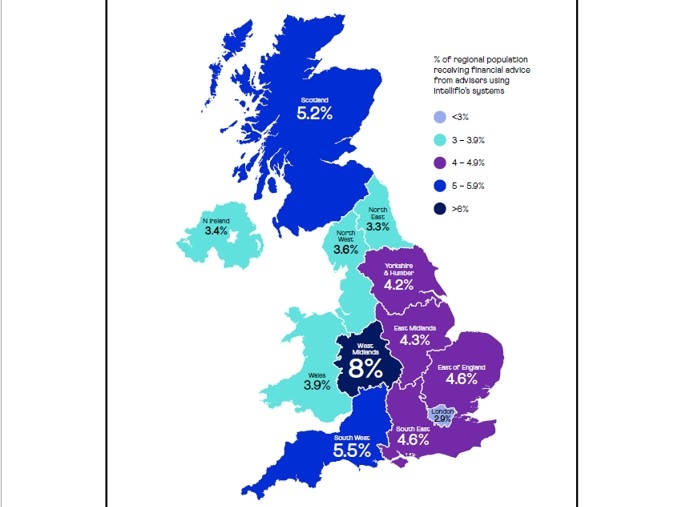

There were also geographic pockets where more were taking professional financial advice. Scotland and the South West of the England had 7.2% of the local population receiving advice, in comparison to just 4% in London and the North East of England.

There was also a continuing gender divide, with women making up just 43% of those receiving financial advice. Northern Ireland held the widest gender advice gap 43%, with London having the narrowest gap at 47%.

Relationship status also affected the likelihood of someone to get advice. Of those receiving advice 44% were married or in a civil partnership, 11% were single, 6% were widowed and 1% were divorced.

However, four in ten (40%) of non-advised investors also surveyed (with portfolios of a minimum of £100,000 in investable assets) cited cost as the highest barrier to paying for financial advice.

To create its report Intelliflo captured data on all customers on its client database that had actively paid or have a valuation in place for professional advice within the last two years.