So-called ‘millennials’ have been deterred from investing, with 96% aged 25-34 ruling out building portfolios because investing is too ‘complicated.’

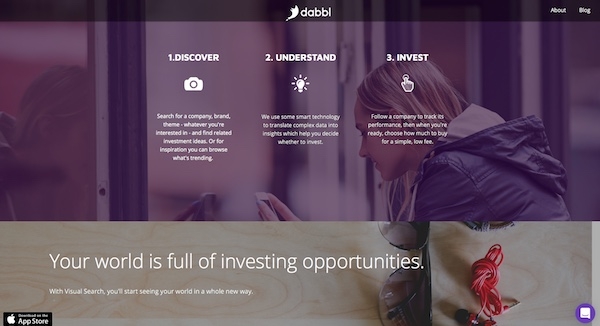

That is according to a new survey by investment app Dabbl, which says disengagement threatens the future of innovative British business.

The main reason for lack of participation was a perception that the process is too complicated, a belief held by 72% of respondents.

Just under two thirds of the 2,002 adults surveyed thought investing was “something reserved only for the financial elite”.

The poll did reveal that the age group had considered investments, before rejecting the idea, with 61% saying they had thought about investing to some degree.

The data also unveiled an eagerness among millennials to invest funds in brands such as Apple, ASOS, Coca Cola and Nike, rather than relying on ‘smart banking methods’ to generate a profit.

Half (53%) thought this approach would generate a better return than say, for example, opening a cash ISA.

Reluctance to placing trust in banks was the result of a feeling that brands are a safer investment (24%), bank interests are too low (24%) and their favourite brands are always innovating and evolving (20%).

Dabbl co-founder and chief executive Mark Ackred said: “The findings of this survey revealed the true extent of the lack of confidence, tools and know-how among young people in the UK when it comes to investing money.

“This is something that could have a real impact on the future of British businesses, who rely heavily on investment to grow and develop.”