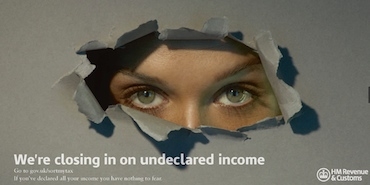

The days of hiding money in another country to cheat the UK are running out, HMRC has pledged, as a new advertising campaign targeting taxpayers with money hidden in offshore accounts begins.

Starting today, HMRC is running adverts in national newspapers and weekly magazines.

Anyone who fails to declare all their income will have to pay the tax itself as well as penalties of up to twice that sum, and could face prison.

{desktop}{/desktop}{mobile}{/mobile}

The launch comes as G20 ministers welcomed a new global standard to automatic tax information exchange at at the G20 meeting in Australia over the weekend.

They called on the governments of financial centres to sign up to new international tax information sharing agreements.

The G20 said that it will continue to focus on ensuring that developing countries benefit from automatic information sharing alongside developed economies.

The G20 finance ministers also restated their commitment to fighting profit shifting by multinational corporations to avoid paying tax.

The UK has already entered into new information-sharing agreements with the Crown Dependencies and Overseas Territories which will provide HMRC with access to more data than ever before on offshore accounts held by UK taxpayers.

The UK, following an agreement reached last year with France, Germany, Italy and Spain, will also move quickly to implement the new global standard on a multilateral basis.

So far 42 countries and jurisdictions have joined the initiative to clamp down on tax evasion.

Jennie Granger, HMRC's director general for enforcement and compliance, said: "The days of hiding money in another country to cheat the UK are coming to an end.

"We are getting more and more information that helps us to target offshore tax cheats more effectively than ever before. If you have assets offshore you need to get in touch with us urgently, because we will catch up with you."

Chancellor George Osborne said: "By taking global action to reform the system alongside a tough approach to enforcing the law at home, we will close the net on those who think they do not have to play by the rules."