Cofunds has noted a disconnect between what clients say they want from financial advisers and what advisers think they want.

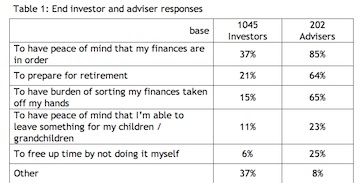

The firm asked over 1,000 consumers prior to RDR and over 200 financial advisers on what they were seeking from financial advice other than practical help.

The firm gave five sample answers 'peace of mind', 'prepare for retirement', 'have the burden of finances taken off my hands', 'free up time by not doing it myself' and 'peace of mind of leaving something for children and grandchildren'. Respondents were invited to tick all those that applied to them.

While 37 per cent of consumers said peace of mind, 37 per cent said they were also seeking advice for a different unspecified reason.

In contrast, 85 per cent of advisers felt their clients were seeking peace of mind while 65 per cent felt their clients wanted the burden taking off their hands. Just eight per cent could think of another unspecified reason.

{desktop}{/desktop}{mobile}{/mobile}

Verona Smith, director of marketing at Cofunds commented: "This was just a toe the water to get a sense of what it is end investors are looking to their financial adviser to provide beyond the practical side of securing their long-term financial future. The results raise a number of questions which warrant further and fuller investigation, in particular getting to the bottom of what exactly those jobs are that come under 'other'.

"It also raises the question that of those looking for 'peace of mind', what form does that take and how can it be built upon? Is peace of mind conferred through professional qualifications? Through familiarity where the adviser over time becomes a trusted friend? Through the adviser being perceived as an independent subject expert? Or through some sort of quality mark? If the latter, then is the industry getting behind marketing a financial advice 'kite mark', such as the ISO22222 standard the answer?"

Cofunds said it would be carrying out further research to establish what people want from their financial adviser.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.