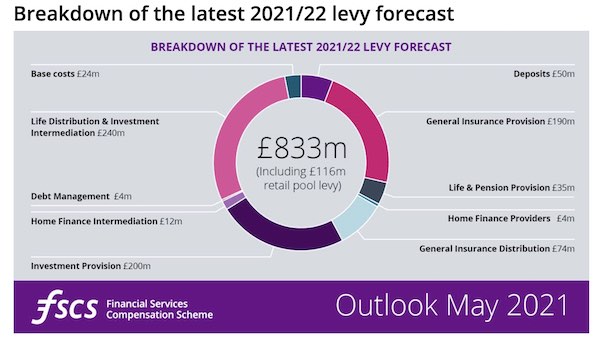

The FSCS has cut its latest levy forecast by £206m from £1.04bn to £833m but the body has warned that the levy on advisers is unlikely to change.

The forecast of the levy component falling on financial advisers is unchanged at £240m due to this class already breaching its levy limit.

The FSCS warned that it expects “high levels” of complex pension advice claims in the coming year and further failures of SIPP operators.

Some of the complex pension advice claims are also now seeing higher compensation awards, the FSCS said.

The compensation body cut its levy forecast mainly due to an unexpected surplus of £96m from last year. It says government support during the pandemic has kept failing firms in business for longer than expected but this means failures have only been pushed back a year. The FSCS also saw lower levels of insurance failures, according the forecasts published in its Outlook publication today.

FSCS CEO Caroline Rainbird says the cut in the forecast is a positive step but there remains “incredible uncertainty” and the pandemic has made forecasting claims difficult.

Ms Rainbird said they underlying reasons for the rapid rise in the levy over the past few years remained and had to be tackled.

She said: “The levy is still too high. To deliver a sustainable reduction in the levy over time all stakeholders need to tackle the root causes of the problem, not just the symptoms.”

She added that in submissions to the FCS over levy reform the FSCS favoured whistle-blowing and “simple products” for consumers to cut risk.

The FSCS also wants it to be compulsory for providers to tell consumers about whether their products are protected by the FSCS.

On SIPPs the FSCS forecasts compensation costs of £241m for the investment provision class. It said the compensation cost for this class is a significant (73%) increase on the £140m cost for 2020/21. It said: “This has been driven by ongoing trends of failures in this class.”

The FSCS is also becoming more concerned a surge in online consumer scams.

Ms Rainbird said: “The scale of the issue is truly shocking, and I sadly suspect what is being reported is only the tip of the iceberg. We are reporting to the FCA at least one phishing attempt and at least one fake investment website per day.”

The FSCS wants to see financial scams included in the Government’s Online Safety Bill.