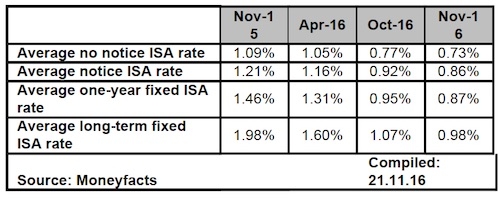

Moneyfacts UK Savings Trends Treasury Report data highlights that all cash ISA averages have fallen below the 1% barrier for the first time on Moneyfacts records.

The data provider says that banks and building societies embarked on a further round of rate cuts following the recent Bank of England base rate cut. The move is likely to nudge more people to look elsewhere to boost their returns from cash savings.

Charlotte Nelson, finance expert at Moneyfacts, said: “We are still seeing the fallout from the Bank of England’s base rate cut, with rates continuing to fall. ISA rates have been hit particularly hard and as a result the long-term fixed ISA rate, the last bastion of hope, has slid below 1.00% for the first time.

“Activity in the ISA market tends to remain stable in the winter months, with most of the activity occurring during the ISA season, so the fact that providers are actively cutting at this time of year is notable.

“The ISA market has had the biggest shock to rates, which is in part due to the fact that these deals have historically paid higher rates than standard accounts, therefore giving providers more room to cut rates in this area.

She added that the new Personal Savings Allowance - which means most people will avoid tax on their personal savings below £5,000 - also has “a lot to answer for”. Since its introduction in April the appetite for ISAs from both providers and savers has dropped dramatically, causing rates to plummet, says Moneyfacts.

She predicted savers would now have to do some “soul and savings deal-searching” to ensure they are still getting the maximum return from their savings pot.

The Moneyfacts UK Savings Trends Treasury Report is out later this month.