Transact has announced this morning that it will cut its annual commission by 0.015% from April.

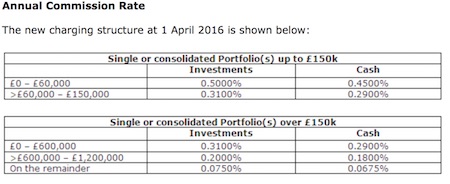

The platform’s last price reduction came into effect on 1 November. From 1 April it is reducing the rate from 0.325% to 0.31%.

Jonathan Gunby, chief development officer, said: "Our commitment to service development and delivery has enabled us to become the platform others aspire to be.

“Successive price cuts have had a positive impact on our net flows and profitability while providing benefits to both advisers and their clients. Funds under direction now exceed £20bn and we are again passing on savings derived from our scale and specialisation in the wrap market."

Over 5,600 Financial Planners and advisers use the platform, it said, to manage more than £20 billion on behalf of more than 126,000 investors.

Last year sister publication Financial Planner magazine asked chief executive Ian Taylor about some observers’ view that there was a price war in the platform sector.

Asked if he believed this to be the case, if it would continue and what the dangers would be in putting price before service, he said: “There's no war. But there has been sniping since day one. We will never put price before service – as service is our reason for being.

“That said, we have adjusted our charging on several occasions as part of a pricing policy that combines two elements.

“The first is what we call "responsible pricing" which means charging what you need to charge to be a sound and secure business in order that long term clients can rely on you in the long term.

“I am frightened by businesses that seem to have put pricing before survival, let alone before service. The second is avoiding greed – so sharing profits from time to time with customers as well as with staff and shareholders.”