A 65-year-old with a £100,000 pension could earn up to £7,430 per year from an annuity, the highest since last October, according to data from Hargreaves Lansdown.

The figure is just a shade under the highs experienced in the aftermath of the mini-Budget in 2022.

In October 2022 a 65-year-old with a £100,000 pension could get up to £7,586 a year – the highest income seen since before the global financial crisis.

But after the Bank of England pressed pause on interest rate rises, incomes fell back, prompting speculation as to their future direction, said Helen Morrissey, head of retirement analysis, Hargreaves Lansdown.

She said: “The good news is that in recent months incomes have been quietly on the rise.

“Annuities continue to deliver the best value we’ve seen in years, and we can expect to see interest in them continue to grow from people looking to secure a guaranteed income in retirement.”

Annuity providers have announced strong sales, and Canada Life recently reported record individual annuity sales of £1.2bn for last year.

Canada Life figures suggest that the income ofered on a £100,000 annuity climbed 54% between January 2022 and this January.

Nick Flynn, retirement income director at Canada Life said: “The annuity market is incredibly busy, as clients seek to capitalise on the relatively high incomes currently on offer.”

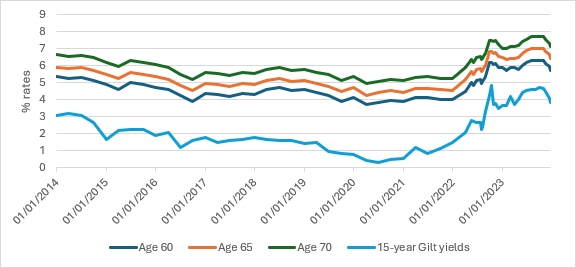

Looking ahead, he pointed out that annuity rates are closely linked to the returns available on government bonds.

He said: “As the Bank of England sets the base rate, this in turn changes the yields on these bonds, or gilts, as they are known. As a general rule, a 30-basis point rise in yields on gilts would increase annuities by 3%.”

He said that while inflation remains higher than the 2% target rate set by the Government, the Bank of England will “tread very carefully before” considering reducing the base rate.

In fact, at the last MPC meeting, two of the members voted to increase base rate, He said: “So, on that basis, annuity rates are likely to remain at or near recent historical highs.”

However, he pointed out that wider market forces can change rates, for example, competition from providers who offer annuities in the open market seeking market share.