Sales of pension annuity contracts jumped 24% in 2024 to 89,600, according to new data from the Association of British Insurers (ABI).

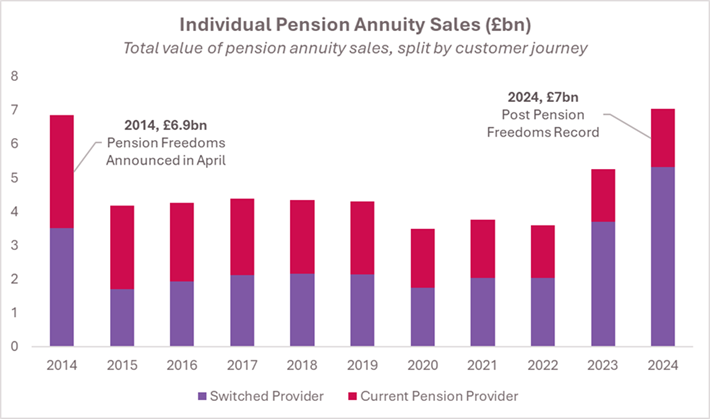

Total annuity sales reached £7bn, a 34% increase on 2023.

Rising rates helped annual annuity sales hit a new 10 year high, beating the £6.9bn seen in 2014 following the implementation of the Pension Freedom rules.

The number of annuity purchases taking place following financial advice rose in 2024, with 36% of buyers having taken professional advice beforehand in comparison to 29% in 2023.

The most common age to purchase an annuity continued to be 65, accounting for 20% of all sales in 2024.

Source: ABI

Last year also saw a record number of annuity holders switch providers. In 2024 69% of annuity buyers switched providers, taking an annuity from a different provider to the one where they already held their pension pot, compared to 64% in 2023.

There are currently six providers offering annuities to new customers.

Rob Yuille, head of long-term savings and policy at the ABI, said the figures demonstrated how important annuities can be as a tool for those looking to secure a reliable retirement income for life.

He added that it was positive to see more pension savers taking advice before an annuity purchase.

He said: “It’s also encouraging to see that more people are taking advantage of professional advice before purchasing an annuity, and are exploring the market to find the best income and a type of pension that is tailored for them.”