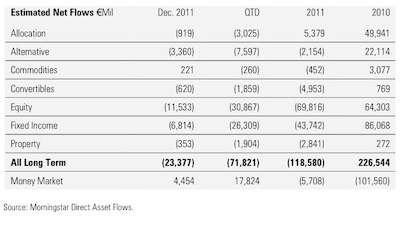

The key findings from a Morningstar research report released today, include:

- Nearly €70 billion flows out of equity funds in 2011; €44 billion leaves fixed income

- Money market funds saw the strongest inflows in December, with €4.4 billion, but flows to short-term funds were negative for the year

- Morningstar's EUR money market short term and EUR money market were the least popular money market categories in 2011, with more than €44 billion in outflows

- Guaranteed funds were especially unpopular in December and throughout the year

- Europe's largest and third largest fund companies, JP Morgan and BlackRock, retained their positions in 2011, due mostly to their USD and GBP money market businesses

- For 2011 as a whole, Franklin Templeton still looks like the big winner among Europe's largest fund families with organic growth of more than 14 per cent

Syl Flood, product manager, Asset Flows, at Morningstar, said: ""The data is showing us just what a bad year it was for the European funds industry. Macroeconomic uncertainty and market volatility clearly scared investors away from all kinds of funds, with outflows seen in equities, fixed income and money market funds. Even guaranteed funds, apparently designed to outperform in any market, weren't popular.

"Only allocation funds saw net positive inflows. The wash of money out of funds in the face of a difficult year for asset markets is understandable, but also of concern as Morningstar research into Investor Returns* shows that investors often cost themselves by selling near the bottom or buying after an asset class has risen. They also incur transaction costs and taxes that might otherwise be avoided. Our analysts therefore routinely caution against attempts to time the market and advocate a focus on maintaining a diversified portfolio structured to meet long-term investment goals."