A financial services firm is encouraging customers to manage their savings on the go by simply touching and swiping a device on their wrists.

True Potential has made it possible for clients to transfer money and deal with their investments on an Apple Watch through a application which can be downloaded.

The move is designed to make saving and investing “even more accessible”.

No longer a simple timepiece, the smart watch technology has transformed the devices into mini mobile computers – an extension of the smartphone trend - and Daniel Harrison, a senior partner at True Potential, said the firm wanted to make the most of the new devices.

He said: “We believe that saving and investing must be made as simple and as quick as possible, so the more we can remove barriers the better.

“With technology that people use every day, such as mobile phones and now smart watches, we can get people out of the habit of spending on impulse and in to the habit of investing for the future. Technology such as ours proves that investing can be fast, easy and even fun.

“We wanted to be the first to add this kind of functionality to the Apple Watch because we know that Apple has a knack of catching the zeitgeist and we pride ourselves on being first when it comes to personal finance technology.

“The Apple Watch is the cutting edge wearable tech, which itself is the future, so the main advantage is that is even quicker and easier to save/invest on the go.”

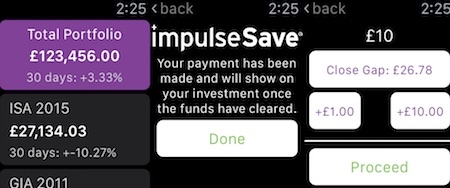

The Apple Watch runs as a slave to the iPhone app so they operate together. The watch version of the app has been simplified to handle the screen size and to make navigation easier.

The iPhone app has had 23,000 downloads but it is not possible to say how many of these are being used specifically on the smart watch. The firm said there was no target for the number of downloads.

The app includes the firm’s own impulseSave technology, which allows investors to top up their accounts on the go from £1.

The company said that there has been £30m of new money invested via impulseSave since launch and almost 40% of it was £10 or under.