The average withdrawal per person from pensions since the freedoms were launched has fallen to under £10,000.

New figures were released by the Treasury today, showing about £7.65bn has been withdrawn from pensions since the reforms came into effect last year.

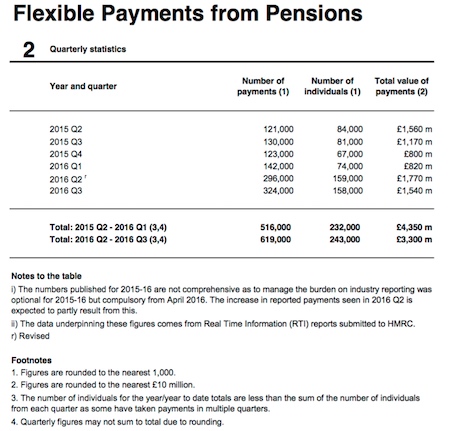

In the latest quarter, £1.5bn was withdrawn by 158,000 people. This comprised 324,000 payments – the highest quarter on record so far, beating Q2’s total of 296,000.

Q3 was the third highest for total value withdrawn of the six quarters so far.

Mandatory reporting was only introduced in April this year, so picture still not crystal clear 18 months on from introduction of reforms, according to AJ Bell.

The Economic Secretary to the Treasury, Simon Kirby, claimed that the figures “prove that allowing people to do what they with their hard-earned savings, whether it’s buying an annuity or taking a cash lump sum, is the right thing to do.”

But AJ Bell senior analyst Tom Selby said: “The pension freedom reforms were designed to both boost flexibility and make pensions more attractive. At the moment the barometer of success seems to be focused purely on withdrawal rates, whereas the real success will be whether people are saving more.”

He said: “These figures show that people are embracing the pension freedoms and flexible withdrawals have now become the default option for income in retirement.

“It is interesting that the average withdrawal per person has gradually reduced since the launch of the freedoms (see chart below), suggesting the initial dash for cash has tailed off and people are becoming more realistic about a sensible withdrawal level over time.

“However, an average withdrawal rate of £10,000 per person in a quarter still feels high in relation to the average pension fund size of around £40,000 in the UK. This shows the limitations of this data.

“To get a full picture of how successful the pension freedoms are it would be good to see what these withdrawals are being used for and to have some sense of how much people have remaining invested in pensions."