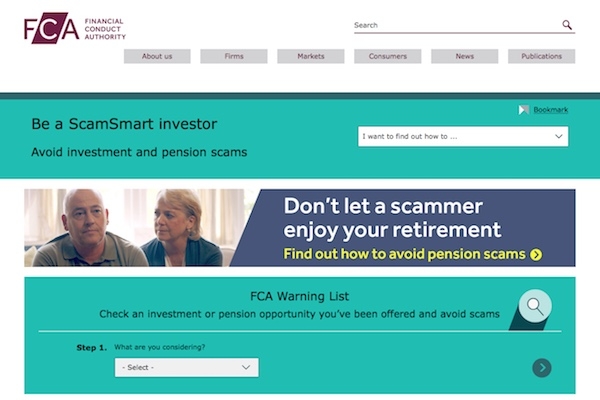

The launch of a new FCA and TPR campaign to boost awareness of pensions scams has been welcomed by the profession.

The high-profile joint FCA and TPR ScamSmart campaign will include TV advertising in a bid to stamp out pension scams where victims lose £91,000 each, on average.

AJ Bell backed the new initiative as it revealed figures it had obtained from City of London Police showed almost £400m has been lost to investment fraud since April 2016.

Tom Selby, senior analyst at AJ Bell, said: “Scammers continue to hound retirees on a daily basis, devising increasingly complex and convincing methods to deceive unwary savers into handing over their hard-earned pensions.

“Since April 2015, when the Pension Freedoms were introduced, fraud activity has increasingly and unsurprisingly targeted over 55s, often luring people to part with their retirement pot by promising huge returns over a short period of time.

“Once the scammers have your money, however, they often disappear, leaving a trail of devastation in their wake.

“There is no sign of scam activity reducing either – in fact, £51m of investment fraud was reported to City of London Police from April to June 2018, up from £30 million in the same period last year.

“While the forthcoming Government ban on pensions cold-calling should mark the start of the fightback against fraudsters, increasing awareness of the dangers of scams is necessary to enable people to protect themselves.”

He added: “Scammers can now target savers in all manner of ways, particularly through social media, and there is clearly a limit to what regulation and Government intervention can achieve.

“If more people are familiar with the signs of a scam then retirees should become less easy prey for these bottom-feeding fraudsters.”

Royal London pension expert Helen Morrissey said: “This joint initiative by regulators on scams is most welcome, but Government needs to be much more proactive.

“Many scams start with a cold call on the telephone yet the Government continues to dither and delay over the cold-calling ban.

“And the main regulation on electronic communications still refers to ‘facsimile machines’ but has nothing to say about social media.

“Until the Government takes this issue more seriously it will remain two steps behind the scammers.”

LEBC also backed the campaign.

Kay Ingram, director of public policy, said: “The joint initiative, by the regulators is welcome and the public are well advised to check the credentials of anyone who offers pension advice on the FCA register.

“The pensions dashboard could be the long-term solution to defeating scams and protecting savers.

“It is disappointing that the Department of Work and Pensions (DWP) have not yet given the green light to this initiative which could revolutionise retirement planning.

“A simple PIN only access to each person’s pensions dashboard would shut out the criminals who steal other people’s pensions.

“Regulated pensions advisers, the DWP and the savers themselves could be given access.

“Consumers would not share their PIN with anyone, just like a bank card they would learn to protect their pension savings from fraud.”