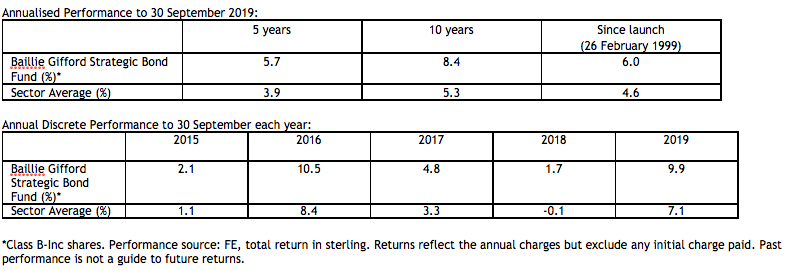

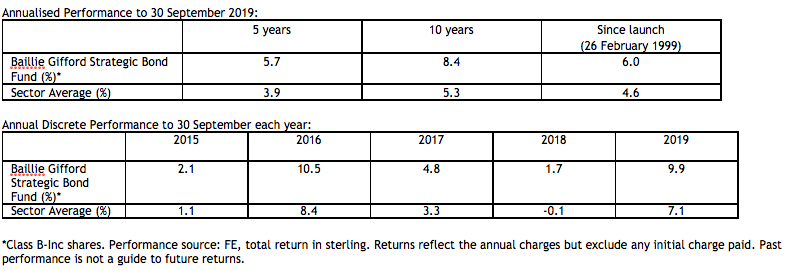

Baillie Gifford is celebrating the 20th anniversary of its Strategic Bond Fund.

Launched in 1999, the fund now manages assets worth over £1.2bn (as at 30 September).

The firm says the fund, which is co-managed by Torcail Stewart and Lesley Dunn, is one of only three in the IA Strategic Bond Sector to have outperformed in nine of the last 10 years.

The Baillie Gifford Strategic Bond Fund is actively managed through global bond selection and strategic asset allocation between investment grade and high yield, plus corporate risk versus government risk.

It targets growing businesses with a sustainable competitive advantage and a resilient capital structure.

Top holdings include Netflix, Bank of America and Virgin Media.

Torcail Stewart, co-manager of the Baillie Gifford Strategic Bond Fund, said: “Our strength and depth of resource has grown significantly over the last 20 years, enabling us to select the best global bonds across a broad diversity of sectors.

“This approach has enabled us to achieve excellent long-term results for clients. As an example, an investment made in June 2000 of £100,000* would now be worth well over £300,000.”

Lesley Dunn, co-manager of the Baillie Gifford Strategic Bond Fund, adds: “As we move into a new decade, investors can expect to see an evolution rather than revolution from the Strategic Bond Fund.

“We are confident our current philosophy and process are well placed for ongoing success, but remain adaptable and will continue to embed ESG factors into our analysis, recognising their significance to company value.

“We are excited about the future and look forward to continuing our endeavours of delivering consistently strong performance, focusing on long-term income rather than short-term yield.”