Nearly 51% of households received more benefits then they paid in taxes, according to the government’s official statistics firm, ONS.

That figure equates to 13.6 million households and the news means the gradual downward trend the ONS has noticed since 2010/11 has continued. Since 2010/11, the ONS has seen a 2% decrease in the number of people who receive more in benefits than they pay in taxes, however, this figure is still higher than the one seen before the economic downturn.

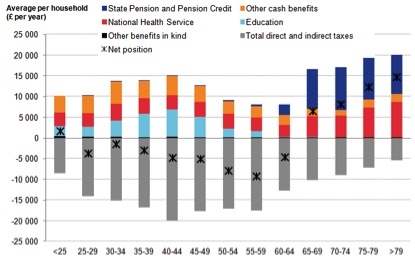

There is a similar scenario when it comes to retired householders as in 2014/15, when some 88.7% received more in benefits than they paid in taxes, coinciding with the classification that the state pension is a cash benefit. The ONS report also revealed that the effects of taxes and benefits are felt differently depending on the ages of the householder.

Those with a household head in their early forties paid the most in taxes, however they also received the highest benefits for those below state pension age.On average, those in their early forties paid £19,800 in taxes, but they received £15,000 in benefits. In contrast, 2014/15 saw all households aged between 24 and 64, pay more in taxes on average than they received in benefits on average.

For those who had a household head aged under 25, they received more benefits then they paid in taxes on average.

The report from the ONS also showcased the impact that direct taxes had on households. On average, £7,700 was paid each year in direct taxes, which equates to 18.8% of their gross income. For the richest householders in the UK, they paid £19,800 each year, corresponding to 22.8% of their gross income.

On the other hand, the poorest households in the UK paid £1,500 per year in taxes. However, these householders witnessed the largest annual increase in the average amount they paid in income tax. The tax year 2014/15 saw an increase of 32% in the amount the poorest householders had to pay in income tax, with the figure increasing from £417 in 2013/14 to £550 per year in 2014/15.

Finally, the report from the ONS also stated that the richest UK householders’ average income was 14 times greater than the amount earned by the poorest. On average, before taxes and benefits those in the top fifth of households had an average original income of £83,800, compared with £6,100 for the poorest fifth, a ratio of 14 to 1.