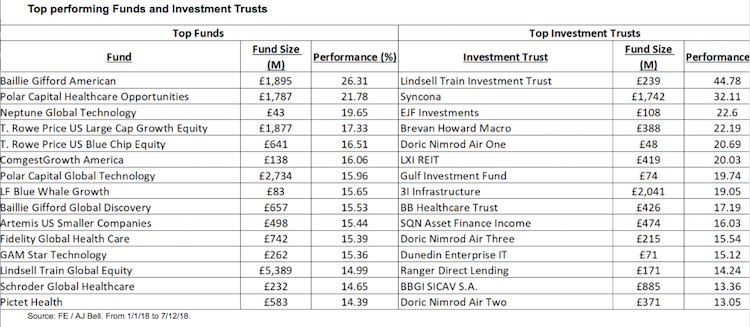

AJ Bell has revealed the best and worst performing funds and investment trusts this year.

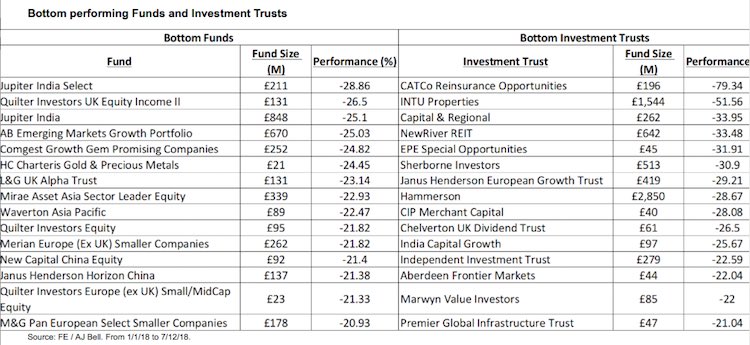

The rundown showed that the Woodford-run Quilter fund was the worst performing UK fund this year and that US focused funds dominated the top performers.

The statistics also revealed that 80% of active fund managers delivered a loss in 2018.

Laura Suter, personal finance analyst at AJ Bell, said: “It proved a tough year for active fund managers, with only 22% of active funds managers delivering a return above zero this year, while 36% of investment trusts delivered a positive return.

“Nowhere were returns harder to find than for UK-focused fund managers, with just three UK Equity Income funds delivering a return above zero this year, while only seven UK All Companies funds out of more than 200 returned more than 0%.”

Commenting on the top-performing funds Ms Suter said: “The top-performing funds in 2018 were dominated by those investing in the US and high-growth sectors, such as healthcare, biotechnology and broader technology.

“Many US-focused funds performed well this year, boosted by the sugar rush that American markets are riding following Donald Trump’s tax cuts earlier this year.

“Baillie Gifford American was the highest performer, investing in a large number of big tech stocks, such as Amazon, Netflix, Google parent Alphabet and Facebook.

“While these stocks have had a torrid time in the second half of the year, they boomed in the first half of the year and some are still up on the year (Amazon is up 38% since 1 January, Netflix is up 34%).

“The S&P 500 index is down 2% this year, with the Baillie Gifford fund up 26.3%, showing the manager’s concentrated portfolio and superior stock picking has delivered this year.

“A number of other American managers comfortably outperformed this, including T Rowe Price’s US Large Cap Growth Equity and US Blue Chip Equity, at 17.3% and 16.5% respectively, as well as Artemis US Smaller Companies at 15.4%.

“These managers all have a style tilt towards ‘growth’ stocks, which have outperformed this year, meaning that when this style is out of favour they will likely underperform the market.”

Speaking about the worst-performers Ms Suter said: “The Quilter Investors UK Equity Income II fund, which is run by Neil Woodford, delivered a 26.5% loss this year, making it the second worst performing fund overall and the worst performing UK Equity fund, bar none.

“Many who’ve been invested in Neil Woodford’s flagship Woodford Equity Income fund have been disappointed with the star manager’s performance this year, returning a 12.7% loss to investors.

“But this fund, also run by him, has performed even worse.

“While the fund is run to a similar style as the Woodford UK Equity Income fund, it doesn’t have exactly the same holdings, and clearly has had more of his losers this year.

“Emerging markets had a troubled year, down around 13% in the year.

“Fears of the impact of the China/US trade war, worries about China growth slowing, and economic meltdowns in Argentina and Turkey have all hurt the region, while the buoyant US economy and a rising Dollar has also hit growth.

“This hit a number of emerging market focused funds.

“The £777m Jupiter India fund was also dragged down, delivering a 25% loss, making it the fourth worst performing fund of the year.

“India has resurged in the past month, but the MSCI India index is still down around 10%.

“It has been hit by the rising US dollar and a higher oil price.

“Avinash Vazirani, who has run the Jupiter India fund for 10 years, has also had a tough year, with some of the small and medium-sized companies he invests in underperforming the market.

“On the investment trust side, the CATCo Reinsurance Opportunities was down almost 80%.

“The alternative trust aims to generate returns from investments linked to catastrophe reinsurance risks, but has been hit by a number of large loss events, such as the Californian wildfires and hurricanes in the US.

“The trust this week revealed that it is now the subject of a regulatory investigation, sending shares even lower.

“Commercial property trusts were also damaged this year, with a failed takeover bid for Intu Properties helping to drag its share price down – landing investors with less than half of their capital at the start of the year.

"REITs with exposure to the retail sector in particular have been hit, amid concerns of a continued slowdown on the high-street, which contributed to Hammerson’s 29% loss this year.”