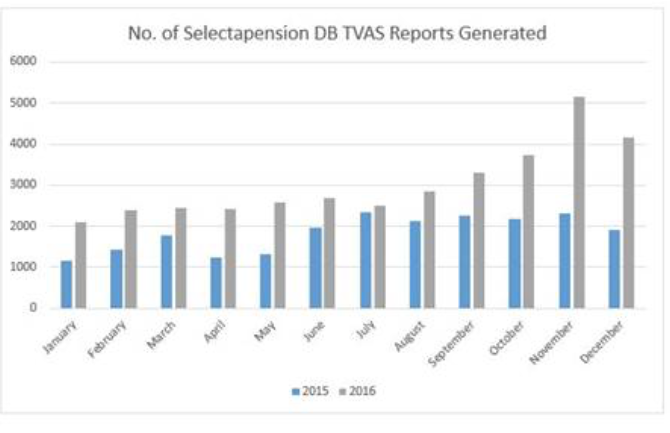

The number of pension transfers out of DB scheme cases that were analysed by advisers and Paraplanners in 2016 rose significantly, research suggests.

Demand for pension transfers out of Defined Benefit (DB) schemes surged year on year, according to pension and investment software provider Selectapension.

There was a 66% increase in DB cases analysed by advisers and Paraplanners in 2016, compared to 2015, the company’s figures suggested.

The demand for transfers increased as 2016 progressed with a 120% increase in DB cases analysed in December 2016 compared to December 2015, the firm stated.

In April 2016 there were 96% more DB cases analysed by advisers than in April 2015. Whilst more cases have been reviewed, the product providers potentially receiving transferred pots hasn’t changed much, according to Selectapension.

For advisers who are not authorised or don’t have the time or inclination to manage complex DB cases, there has been an unprecedented demand for Selectapension’s bureau services, the company reported.

Peter Bradshaw, national accounts director, Selectapension, said: “Transferring out of a DB scheme is a complex process, and it can also be a lengthy one. With full scheme information, a TVAS report can be produced within an hour, but the whole transfer process can take months.”

A TVAS is an automated system which calculates the investment return which is required from a personal pension fund to provide the same benefits as those given up by transferring.

He added: “We welcome the recent FCA’s guidance on pension suitability which recognised that clients’ personal circumstances can trump critical yields.’’