The choice to opt out of auto-enrolment should be scrapped, BlackRock's chief executive has told a major pensions conference.

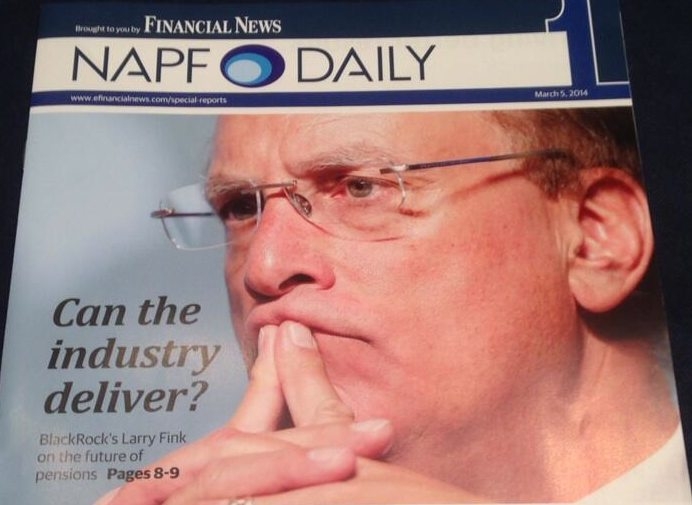

Larry Fink told industry leaders in Edinburgh yesterday that saving for retirement should be compulsory.

He backed the Government's auto-enrolment scheme but said the option for workers to duck out should be removed.

His comments at the National Association of Pension Funds Investments Conference come after The Policy Exchange called for the opt out to be axed in January as part of a wider proposal.

{desktop}{/desktop}{mobile}{/mobile}

It warned 11 million people are at risk of entering 'pensioner poverty' when they retire.

Mr Fink said that compulsory retirement savings would help solve what he called the UK's pensions crisis.

Mr Fink said: "As I have advocated in the U.S., I would recommend simply making an appropriate level of retirement savings mandatory here in the UK, without the opportunity to opt-out.

"This has been done with the superannuation system in Australia and has proven to be extremely effective. There is too much risk that people will either opt out, or not put enough away even if they remain in a plan."

Despite calling for more action, Fink praised the industry for its work, and backed the raising of national retirement ages.

Office of National Statistics data showed average life expectancy in the UK has soared to 80 years old – eight years higher than in the 1970s – meaning retirement income will need to stretch further than ever.

Mr Fink said: "It took real courage to raise the retirement age to 68 and then to 69, one of the highest eligibility thresholds in the world.

"The NEST plan and auto-enrolment initiatives are having a marked effect on the retirement landscape in the UK."