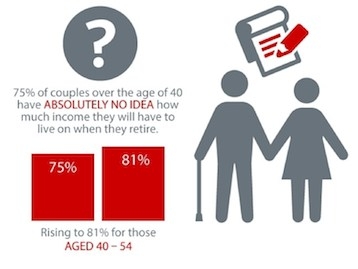

Three-quarters of Britons say they have no idea what their income will be in retirement, rising to 81 per cent for those aged 40-54, according to Prudential.

A survey of 2,000 couples aged 40+ questioned couples' attitudes to their finances and their retirement.

Some 17 per cent of people said they did not know what their main source of income would be in retirement and 11 per cent said they would be looking to other sources of income rather than their pension.

Some seven per cent said they would be completely dependent on their partner in retirement, rising to 10 per cent of women.

Regarding Financial Planning, less than half of couples surveyed had made joint retirement arrangements to ensure their partners are protected if they die.

{desktop}{/desktop}{mobile}{/mobile}

Some 26 per cent have never discussed what will happen to their pensions while 13 per cent said making a will was the only Financial Planning activity they had completed.

Vince Smith-Hughes, retirement expert at Prudential, said: "The fact there is so much confusion among couples around retirement planning also emphasises the importance of seeking financial advice, to make sure you put in place the most appropriate retirement arrangements.

"Taking into account what benefits will continue after one partner dies is an important part of selecting the right solution."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.