A survey by HSBC has found that 29 per cent say they never save at all and a further 29 per cent of people did not save anything in 2011.

The survey, reported in the HSBC Savings Map of Britain, questioned over 2,000 people.

Some 33 per cent of people said they withdrew more than they invested while 35 per cent said they saved more than they withdrew.

The average amount being saved was £213 although this dropped to £111 for those aged 16-24.

Those living in London and the South East contributed most to their savings with monthly savings of £337 per month compared to Scotland which only saved £192 per month.

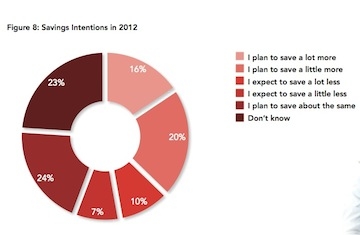

Regarding the outlook for 2012, 36 per cent of people plan to save more than in 2011 while 16 per cent plan to save a lot more.

Only 45 per cent of people expected the amount they were saving to stay the same but this figure increased to 55 per cent for those aged 55+.

Most people were saving for a rainy day while fewer people were saving for long-term goals.

Bruno Genovese, head of savings at HSBC, said: “While this year is also likely to prove a challenge for British savers, intentions to save remain high with people aware of the need to build up a savings cushion in case of a rainy day or to achieve their long or short term goals. These findings suggest Brits will save where they can afford to in 2012.”