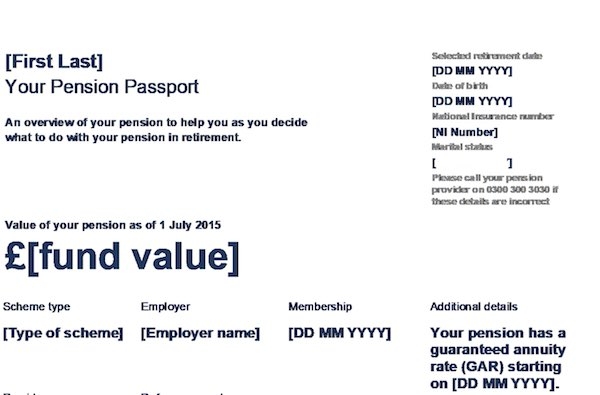

A government-backed working party has found that sending pension savers a single A4 ‘Pension Passport’ sheet summarising their pension pot can improve consumer action and engagement significantly.

Those receiving the Pension Passport were 10 times more likely to make use of the free Pension Wise guidance service, according to investment firm Hargreaves Lansdown which has been a long term supporter of the Pension Passport idea.

The Behavioural Insights Team working party carried out a major long term study on behalf of Pension Wise to increase engagement with Pension Wise, the government provided pension guidance service. It found that bombarding pension holders with bulky pension information in the ‘wake up’ pack sent just before retirement significantly dissuaded people from taking action.

The team carried out a comprehensive study using three trials with providers to assess the reasons for poor engagement with the pension process near retirement. It cited an FCA study showing that only one in three pension savers, for example, shopped around for an annuity even though most could have benefited from doing so.

The huge amount of pension information sent to pension savers was found to be a major reason for consumers failing to shop around. Confused consumers either opted for a default option or gave up trying to take action or seek advice, unsure of what to do.

Hargreaves Lansdown says the team’s report should lead to pension savers receiving “simpler, clearer communications” in future which should help them to make better decisions about how and when to draw on their retirement savings. A single A4 ‘Pension Passport’ sheet at the start of any pack stating clearly how much a pension fund was worth was seen as a key to boosting engagement with pension savers and encouraging more to take action or seek advice.

Tom McPhail, head of policy at HL, said: “This evidence confirms what a lot of businesses probably knew already; customers are more likely to act on simple, clear concise information, whilst lengthy complicated documents tend to cause customers to disengage.

“Given this evidence we hope all companies will now adopt a simple, Pension Passport type approach to help their customers make good decisions with their retirement savings. Where necessary, the FCA and the DWP should intervene to ensure all pension providers adopt this approach.”

“Most people know how much is in their bank current account and how much their property might be worth; hardly anyone has even a vague idea how much their pensions are worth until they almost ready to retire. This has to change.”

The Behavioural Insights Team, in its conclusions to its report, said: “The current wakeup packs provide so much information to customers that it makes it difficult for them to digest all of it and feel empowered to make a decision with their pension pots.

“The size of the packs could even lead to total disengagement with the material. By significantly reducing the total amount of information sent to them, by focusing on the essential information they need to start engaging with the pension market, we increase engagement with the PW (Pension Wise) website and calls to the PW booking line.”

The Behavioural Insights Team carried out trials on different kinds of packs on behalf of the Pension Wise service. The team worked with Royal London, Standard Life and LV= trialling a series of different packs to see which worked best.

Pension companies, including LV=, Just, Hargreaves Lansdown and Retirement Advantage formed the lobby group the Pensions Income Choice Association in 2009 which first proposed the concept of a Pension Passport.