Cashflow modelling has been included among the key competencies required of trainee advisers entering a new national Government apprenticeship scheme.

Expectations and formal standards for adviser apprentices have been published by the Skills Funding Agency.

The methods of assessment comprise a case study test worth 30% of the overall grade and a viva, worth 70%, based on a portfolio of evidence put together by the apprentice. To pass, apprentices will have to reach 65% at least.

The trainee positions will last between 24 and 30 months, and should be reviewed after a maximum of three years, the agency’s official papers showed.

Use of cashflow modelling is referenced as an important skill in the documents.

This comes soon after a recent debate on Financial Planning Today about whether cashflow modelling is essential to ‘true’ Financial Planning. About 78% of the 215 readers who took part said yes.

Related

Cashflow modelling feature in issue 3 of Financial Planning Today magazine

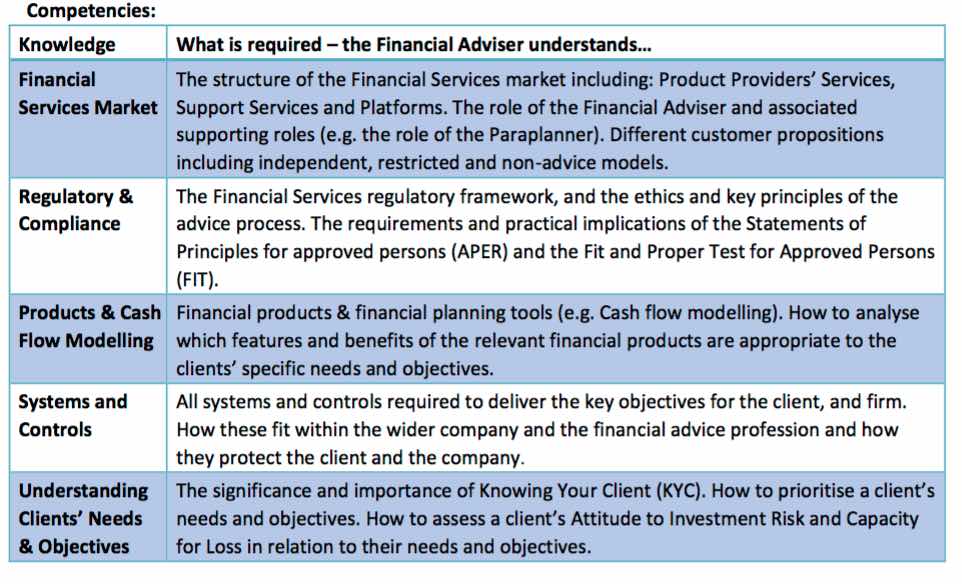

Products and cashflow modelling are listed as a key category under a section called competencies, at the top of the first document outlining standards.

This stated that apprentices must show competence in “financial products and Financial Planning tools (e.g. Cashflow modelling).”

They must show “how to analyse which features and benefits of the relevant financial products are appropriate to the clients’ specific needs and objectives.”

Under a section entitled ‘Products & Financial Planning Tools’, the apprenticeship papers stated that trainees must: “Understand and utilise the appropriate tools to support a customer recommendation which includes cash flow modelling, risk profilers and product sourcing tools.”

An apprentice will have to demonstrate “an ability to use third party tools such as spreadsheets or cash flow modellers to explain the impact of key events on the client’s objectives and utilises such tools to help prioritise the objectives.”

Under the assessment overview, the agency states that for the case study test apprentices must show knowledge within this of “products and cashflow modelling”.

Table Source: Skills Funding Agency

Other required knowledge will include comprises regulatory and compliance, systems and controls, and understanding clients' needs and objectives.

The viva is described as “a structured interview lasting at least 1 hour between the apprentice and an assessor”.

The viva and portfolio should test a minimum of 25 of the learning outcomes from the skills and behaviour competencies, the agency’s papers stated.

The financial adviser standard has been developed by:

• Sense

• Lighthouse

• Succession

• Openwork

• Tenet

• Sesame

• Towry

• The Beaufort Group

• Santander

• Ablestoke Financial Planning