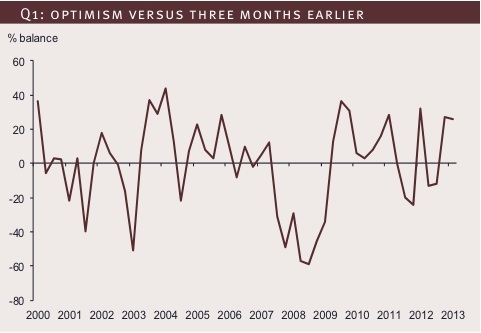

According to the latest CBI/PwC Financial Services Survey, activity in the sector, including employment, rebounded strongly in the three months to March, with a robust rise in business volumes and an increase in profits.

Profit growth was driven mainly by a further widening in spreads and an increase in income from fees, commissions and premiums. But the pace of growth was slower than expected, in part because of a surprise rise in costs, particularly staff costs, following an unexpected rise in employment.

Financial services companies said they were more optimistic about their overall business situation and business volumes and profits are both expected to grow again in the next quarter. However, regulation and compliance costs are likely to remain a drag on business.

Matthew Fell, CBI director for Competitive Markets, said: "This has been a strong quarter for the financial services sector, with robust growth in business volumes, an increase in profitability and upbeat investment intentions.

"Concerns over the lack of availability of professional staff have eased since January and overall employment rose unexpectedly this quarter.

"But recent problems in Cyprus risk reigniting concerns about Eurozone stability. At the same time, regulation and compliance are still likely to be significant drags on business throughout this year."

{desktop}{/desktop}{mobile}{/mobile}

Key findings include:

• 48% of firms said business volumes increased and 17% reported a fall, giving a balance of +32%

• Business volumes grew in all customer categories: industrial & commercial (+20%), financial institutions (+12%), private individuals (+16%), overseas customers (+8%)

• 39% expect business volumes to increase next quarter while 12% expect them to fall, giving a balance of +27%

• Income from fees, commission or income rose (+18%)

• Income from net interest, investment or trading was fairly flat (+3%)

• Total costs increased (+13%), driven by a rise in staff costs (+12%)

• Average spreads widened (+7%)

• 34% of firms said profits increased and 15% reported a fall, giving a balance of +19% - not as strong rise as expected (+38%). Profits are expected to increase again next quarter (+14%)

• 35% of firms reported a rise in employment and 16% a fall, giving a balance of +19% - a similar increase is expected next quarter (+18%)

• Based on the correlation of the CBI's survey data with the ONS, Financial Services sector employment is expected to have increased by 2,000 in the three months to March and is expected to increase again next quarter, by 2,000

• Regulatory compliance is expected to be an increasing burden in the coming year, limiting the level of business (23% of respondents) and adding to costs (a balance of +61% expect to increase regulatory spend over the next twelve months, compared with +49% last quarter)

• Financial services firms said they planned to launch more new products and services in the year ahead to drive business growth (+36%).

There some areas of disappointment such as In life insurance business volumes fell sharply over the last three months, for the first time since December 2009, particularly with private individuals. This led to a decline in profitability, disappointing expectations of a strong rise, partly counterbalanced by falling average costs. Numbers employed fell at the strongest rate since December 2010. Business volumes are expected to fall rapidly again next quarter.

However in investment management business volumes saw the strongest rise since December 2010. Profitability increased for the fifth consecutive quarter, as growth in average commissions, fees and premiums accelerated and income values rose strongly. Volumes are expected to grow solidly again in the coming three months.