Retirement income planner Chancery Lane, run by Chartered Financai Planner Doug Brodie FPFS, has launched a free online tool on its website which enables income seeks to model historical investment income versus RPI (Retail Prices Index), the older measure of inflation still used for many pensions.

Chancery Lane’s research covers income yields back to 1987.

It uses this data to power the ‘Research Yourself’ online tool, available on the website www.chancerylane.net.

The calculator allows investors to input their own details and select portfolios based on actual historical UK data and compare the actual returns to the historical inflation figures year by year.

RPI (the Retail Price Index) is currently 11.1%, significantly above the CPI rate of 9%, the government's key measure of inflation. RPI is still in use with many pension schemes as a benchmark to assess annual increases.

Investors using the Chancery tool can model their annual income using their pension pot and choose whether or not to include state pension benefits. There is also an option to view, via simple charts, how they would have fared by investing in the FTSE All Share with comparisons between the FTSE and a selected portfolio.

It illustrates the number of years out of 32 with positive returns, the APR over 32 years for total returns and the number of years out of 32 that income fell.

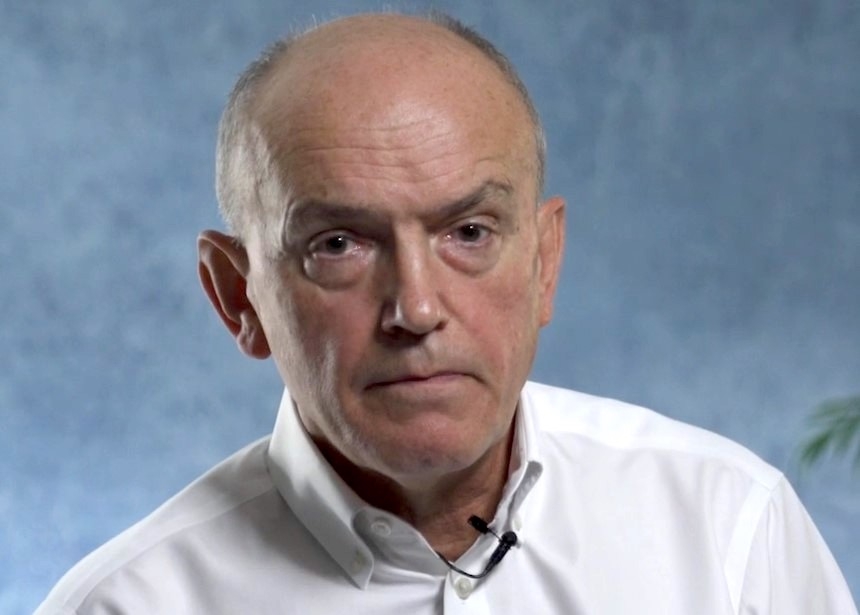

Mr Brodie, founder and CEO of Chancery Lane, said: “Baby boomers know about inflation. Today’s 60 year old hit teenage years when the price of his Spirograph was shooting up in price by 24%. Spikes always occur, and from 1970 to 1980 the average of the annual inflation rates was 13.3%, which meant over ten years, the value of £100 changed to £350.

“During our working years, inflation in prices is normally absorbed into wage inflation, enabling our pay packet to keep up with the prices. But for today’s baby boomers retiring without the safety net of a final salary pension, selecting the correct investment strategy to deliver the right amount of income today and in twenty years’ time, is crucial.