Advisers are concerned about the possible effects of a change to the retail prices index, expected to be announced tomorrow morning.

The Office for National Statistics has been consulting on a change to the way inflation is measured for the past few months. It is expected to announce a move to bring the RPI, which includes mortgage rates, closer in line with the consumer prices index (CPI).

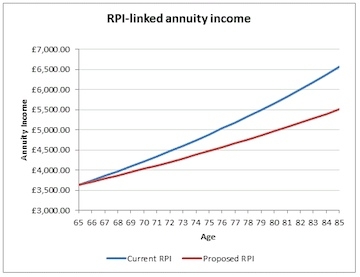

RPI is typically 0.5 per cent to one per cent higher than CPI and it has been suggested this gap will widen to 1.4 per cent over the next decade.

However, advisers are worried about the possible change in measurements as many pensions are linked to RPI and retirees could see significant losses.

{desktop}{/desktop}{mobile}{/mobile}

Tom McPhail, head of pensions at Hargreaves Lansdown, said: "This kind of change can prove to be most damaging of stealth attacks on pensioner incomes; it appears innocuous but over an entire retirement it can slowly deprive pensioners of thousands of pounds."

Nigel Green, chief executive of deVere Group, said: "If the ONS recommends this change, it would be another hammer blow for pension holders who are still in schemes that offer RPI increases, as their annual pension increases would be slashed overnight. Savers and those who invest in inflation-linked investments would be similarly affected."

A change would also affect index-linked government bonds, NS&I index-linked certificates and final salary pension payments.

Any change would come into effect in March 2013.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.