A Chartered Financial Planner has described NS&I interest rate cuts as “another devastating blow for millions of savers”.

NS&I this morning announced that it is reducing interest rates on four of its variable rate products, citing reductions across the savings market after the Bank of England cut the base rate to 0.25% in August.

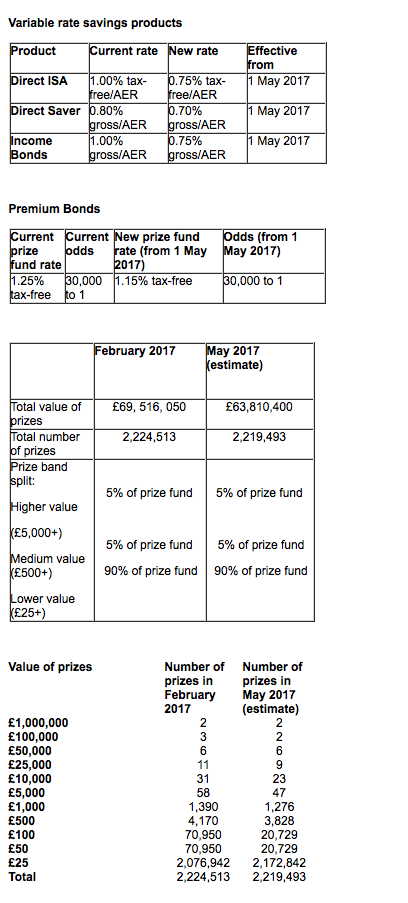

Variable rate changes will apply to Premium Bonds, Direct ISA, Direct Saver and Income Bonds, coming into effect on 1 May 2017.

See table below for more details.

Danny Cox, a Chartered Financial Planner at Hargreaves Lansdown, said: “This comes as little surprise but this cut in interest rates is another devastating blow for millions of savers and the new launch of Investment Guaranteed Growth Bonds will be of little compensation. Ironically with so little interest on cash for savers, Premium Bonds look more attractive – if your savings are returning basically nothing, you might as well opt for the chance of the jackpot prize.”

He said: “NS&I will remain popular for their cast iron security but lower interest rates and rising inflation will test savers’ patience and I expect more people to look to the stock markets for some of their cash to improve their long term returns.”

In the spring, NS&I will be launching Investment Guaranteed Growth Bonds – a new market leading 3-year savings Bond – announced by the Chancellor of the Exchequer in the last Autumn Statement. The new Bonds will be available at nsandi.com for 12 months from spring 2017 with an indicative interest rate of 2.20% gross/AER. The precise rate will be confirmed nearer to launch. The Bonds will be open to people aged 16 and over and will have a minimum investment of £100 and a maximum investment of £3,000.

Steve Owen, acting chief executive, NS&I, said:

“We have taken the time to absorb the impact of the Bank of England base rate reduction and subsequent changes across the savings market. The new rates reflect current market conditions and allow us to continue to strike a balance between the needs of our savers, taxpayers and the stability of the broader financial services sector.

“We appreciate that savers will be disappointed, but we believe that the new rates present a fair offer to customers, who will continue to benefit from our 100% HM Treasury guarantee on all holdings, as well as tax-free prizes for Premium Bonds.”

Table source: NS&I announcement