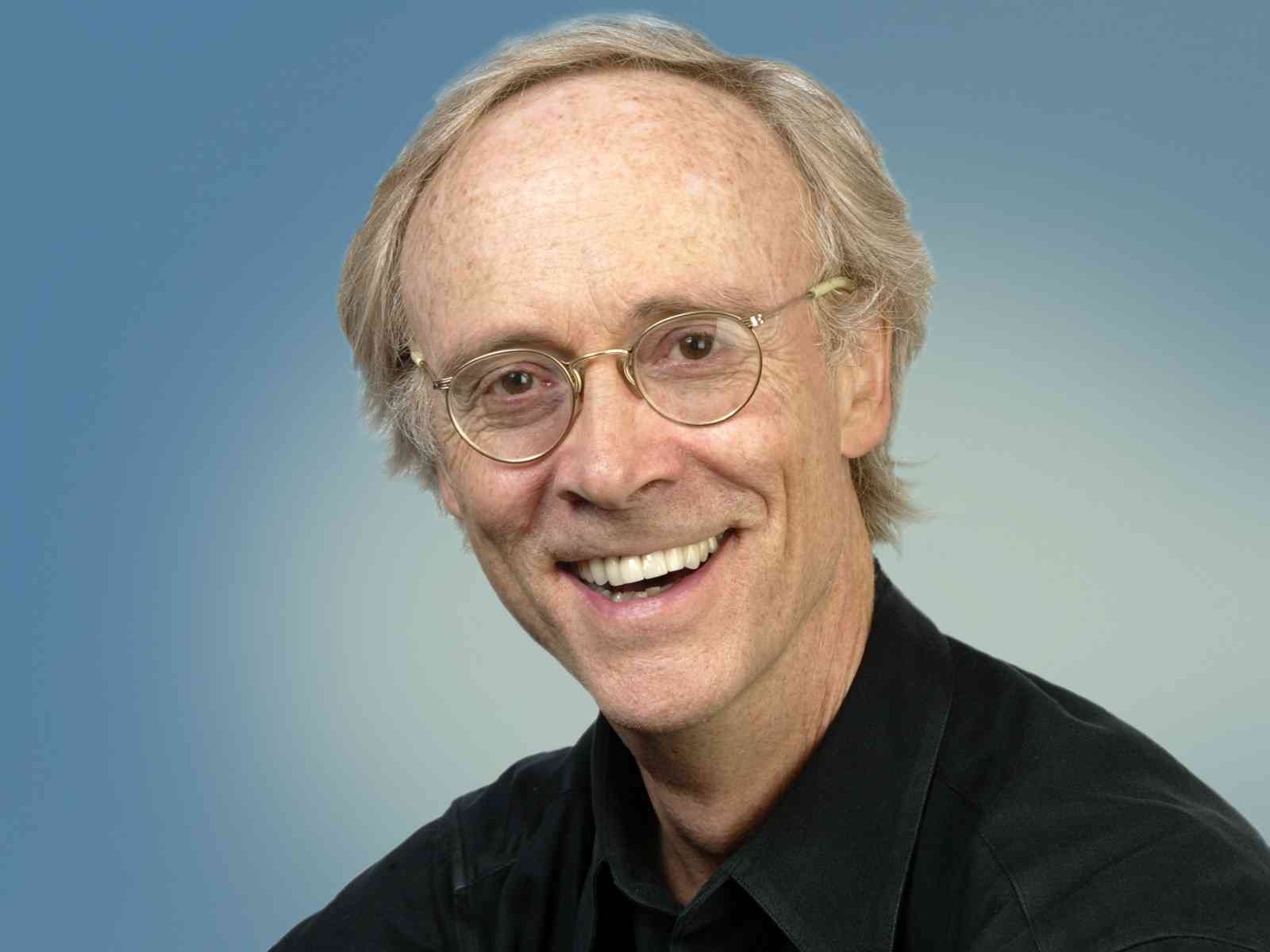

We asked George Kinder, the founder of the global Life Planning movement, for his views on key topics facing planners and his thoughts on the challenges ahead:

1. George, What do you see as the big issues facing Financial Planners globally this year and over the next few years?

The big issue hasn’t changed in many years, and it’s not likely to move closer to the needle in 2019 either. The big issue is trust. The bulk of the population doesn’t trust financial advisers, and as long as the money in the industry is on the product side, that’s unlikely to change. And that’s a shame. It robs the economy of its greatest possible efficiencies that come from a knowledgable consumer, and of the explosions of entrepreneurial spirit that arise in financial Life Planning engagements. Trust, of course, is also a broader issue, seeping into our democracies as well as our economics. That isn’t to say there aren’t movements doing fine work, both for their clients and for the broader society. I am optimistic about change, I just don’t see major change coming either globally or in the UK this year. I personally hope to be a larger part of that conversation after publication of my new book.

2. What are your own plans to develop Life Planning this year?

We will continue to offer our 7 Stages and EVOKE trainings, and I have been surprised and delighted at the engaged and growing community of Registered Life Planners meeting quarterly in our Life Planning Mastery series in the UK and in the US where we have been emphasising Life Planning’s roots in listening skills. We will continue to build the global community of Life Planners and are in discussions to deliver the 5 day EVOKE training on a new continent this year. That will make 4 out of 6!

I see my job this year as expanding consumer awareness of Life Planning and helping them to find Life Planners to work with. I have been giving a new series of speeches in the financial community, as well as to consumers and universities entitled Mindfulness, Life Planning and a Golden Civilization. We are outlining plans to give these talks almost weekly, starting at the end of 2018. Our website for consumers, LifePlanningForYou.com, without advertising, now has 9000 consumers using it to develop their initial life plans and to find life planners to help them.

3. We’re seeing the steady emergence of more AI and robo-advice financial guidance services - do these threaten the future of Financial Planners or will there role have to adapt?

I’m a huge fan of robo-advice. Done well, it cuts costs for consumers and educates them in a way they can trust. Trust is the key. Rather than threatening Financial Planners, I think robo-advice opens the door to genuine financial life planners everywhere. I think it only threatens the sales and product community. If consumers know that they can have both the simplicity and clarity of robo-advice, as well as a wise empathic adviser, who wouldn’t want that combination? Much as I’m a fan of Kinder Institute's consumer website, it can never replace the understanding, clarity and kindness of a trained adviser. I think robo-advice opens financial advisers to the role they have always been destined to play, that of trusted adviser, empathic and wise.

4. Can you tell us about your latest book, what inspired it and when it will be published?

A Golden Civilization takes on the societal issue of trust, and, like Life Planning, is based on our vision of who we want to be. It starts on a precipice 1000 generations hence. Society has arrived at a Golden Civilization, and we are all looking back on 2018 and noting what’s working and will take us directly to the Golden Civilization, and what isn’t working and will lead us astray. Then I set out to address this question in 7 domains: Entrepreneurial Spirit and Advice (the two most directly related to Life Planning), Products, Markets, Democracy, Media and Leadership. I hope to inspire a conversation about the roadmap that will get us there. The book has many large new concepts, including a revision to our map of time and space, based on the present moment, that I call The Map of Mindfulness and that argues that the maps we currently use are all wrong, and lead us to many of the negative externalities we find in society including war and pollution and great inequalities. Partly coming from our experience as Life Planners, I argue that the central economic events should be seen as moments of freedom rather than moments of transaction, and that self-knowledge must replace self-interest as our guiding principle.

The book was inspired by the banking crisis of 2008 and the following economic and democratic upheavals. It is due out toward the end of 2018.

George Kinder, CFP®, RLP®, is the founder of the Kinder Institute of Life Planning and designer of trainings for client-adviser relationship skills. His new book, A Golden Civilization, is due autumn 2017.