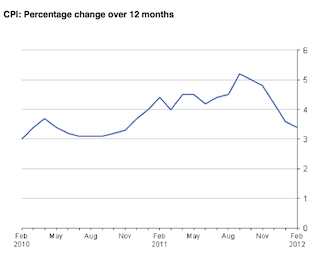

The consumer prices index fell to 3.4 per cent in February, down from 3.6 per cent in January, according to the Office for National Statistics.

The retail prices index, which includes mortgages, fell to 3.7 per cent from 3.9 per cent in January.

The CPI figure is the lowest since November 2010 and compares to a rise of 0.7 per cent a year ago.

Inflation has been falling steadily since its 5.2 per cent peak in September 2011 but still remains above the Bank of England’s two per cent target.

The largest downward pressures to CPI inflation came from domestic electricity which fell by 1.3 per cent and gas which fell by 0.9 per cent. This is the first time electricity prices have fallen in February.

Smaller downward pressures came from recreation and culture which fell by 0.2 per cent compared to a rise of 0.3 per cent a year ago and air fares which fell by 1.6 per cent compared to a rise of 2.1 per cent a year ago.

The largest upward pressures came from clothing and footwear which rose by 2.9 per cent, vegetables which rose by 3.3 per cent and fuels and lubricants which rose by 1.3 per cent.

For RPI, the largest downward pressures came from car insurance and air transport. House deprecation and alcohol had an upward effect on the RPI.

The next announcement will be made on 17 April.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.